Exploring GMX

A Profitable, Decentralized Derivatives Protocol

An Introduction -

What Is GMX?

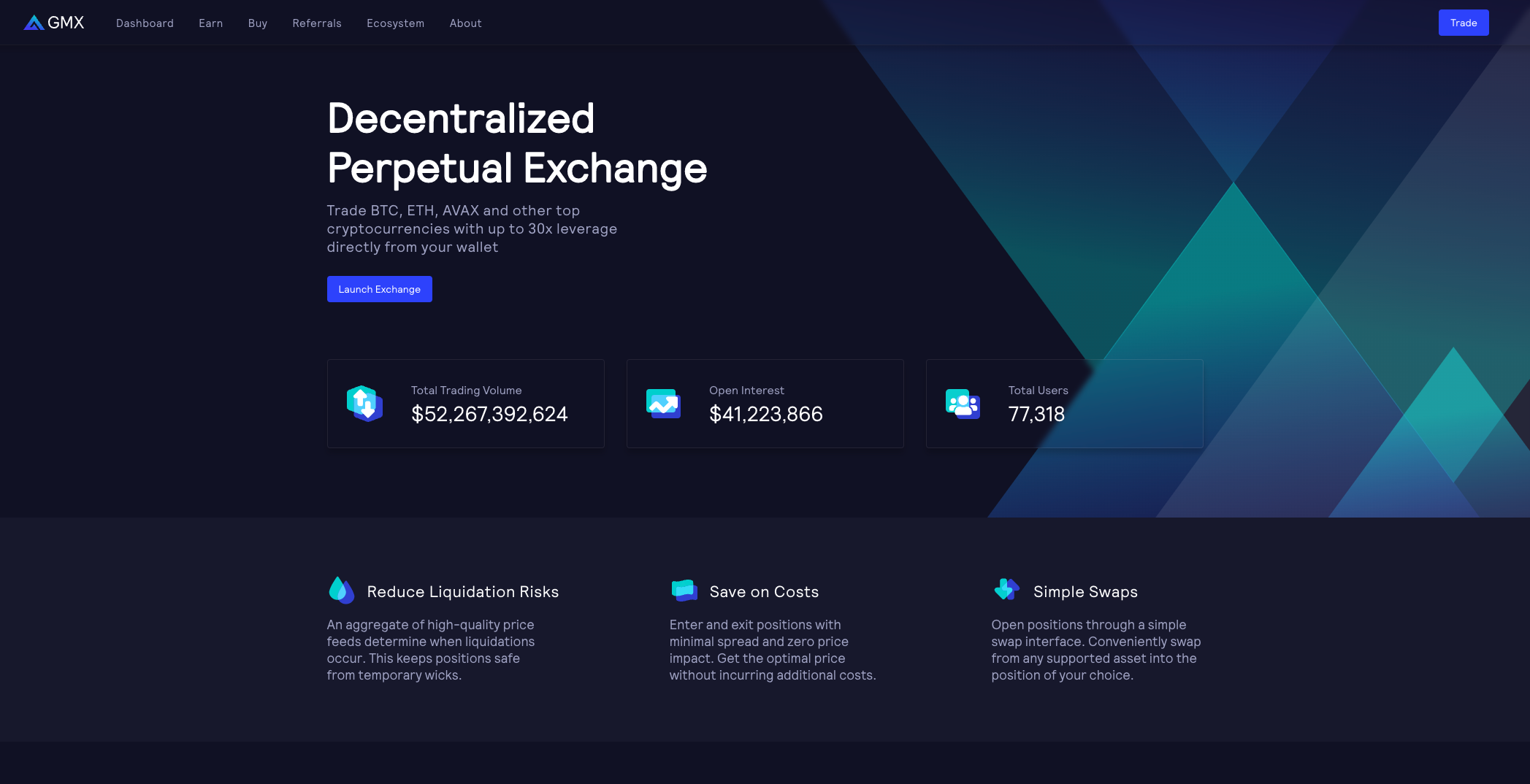

GMX is a decentralized derivatives protocol operating on Arbitrum and Avalanche. Since its launch in September of 2021, GMX has seen an enormous amount of growth in less than a year and has even shown strength in a market downtrend owing to not only a loyal fanbase but a loyal user base, too. Utilising a two-token model, sharing revenue fees with token holders and providing strong liquidity to traders looking to stay off of CEX platforms and retain their anonymity, GMX presents some of the strongest fundamentals we’ve seen in the DeFi/DEX space to date.

Over the next 1,000 words or so, we’ll cover the very highest level of analysis of GMX fundamentals and start to uncover why it’s one of the hottest bluechips in DeFi right now.

If you’d rather get straight into using GMX or checking the stats for yourself, follow the links below to learn more. We’ll include some community created resources and their links as we go.

Chains -

A Multi-Chain Derivatives Protocol

GMX was one of the first protocols to embrace the power of L2 chains as the likes of Polygon were being overloaded by play-to-earn games and experimental dapps not otherwise possible on the main ETH chain. Arbitrum provides GMX with the performance to operate a low latency, high throughput derivatives exchange that traders expect. In 2022, GMX launched on Avalanche and with that brought more users, more revenue and ultimately more opportunities for the protocol to grow outside of Ethereum and L2.

Since launching in 2022, the Avalanche version of GMX has been extremely successful by all counts, reporting $13B in volume, $18m in fees and over 12,000 users at the time of writing, roughly 25-35% the amount boasted by the Arbitrum version. We have no doubt that GMX will explore other chains in the future but their approach appears to be to avoid fragmentation and only expand when the need arises.

Chains -

A Multi-Chain Derivatives Protocol

GMX was one of the first protocols to embrace the power of L2 chains as the likes of Polygon were being overloaded by play-to-earn games and experimental dapps not otherwise possible on the main ETH chain. Arbitrum provides GMX with the performance to operate a low latency, high throughput derivatives exchange that traders expect. In 2022, GMX launched on Avalanche and with that brought more users, more revenue and ultimately more opportunities for the protocol to grow outside of Ethereum and L2.

Since launching in 2022, the Avalanche version of GMX has been extremely successful by all counts, reporting $13B in volume, $18m in fees and over 12,000 users at the time of writing, roughly 25-35% the amount boasted by the Arbitrum version. We have no doubt that GMX will explore other chains in the future but their approach appears to be to avoid fragmentation and only expand when the need arises.

User Stats -

Adoption & Volume

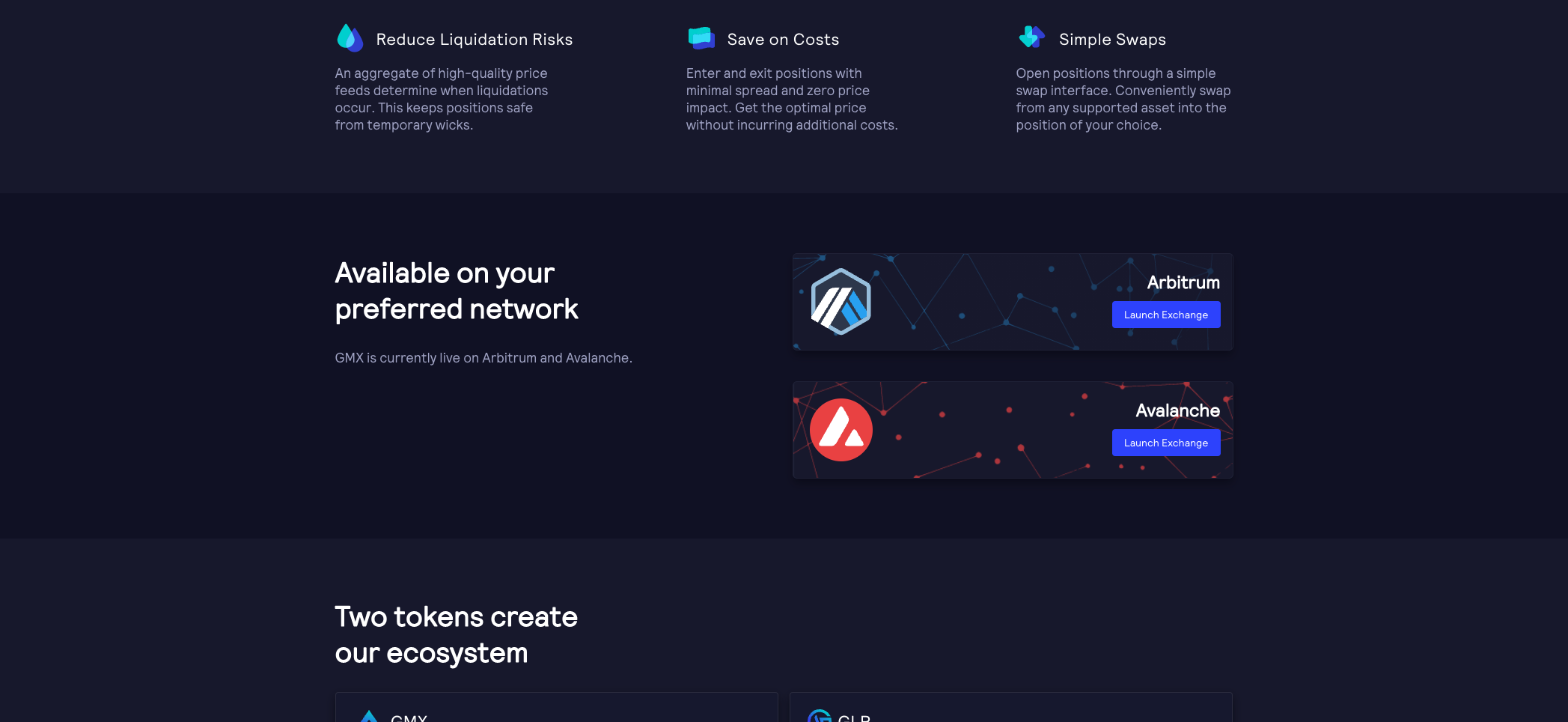

GMX has some of the most impressive user statistics for a protocol that never existed as a dapp on the main ETH chain. The hype around a potential Arbitrum airdrop has created a flood of users looking to interact with an on-chain dapp to secure their spot in the inevitable drop. Due to their being no hard date set on the Arbitrum token launch, GMX continues to see high new unique user numbers which will naturally translate to longer term users.

The above isn’t to say that GMX is only seeing use from “hit and run” users looking to get a few txs in. The numbers speak for themselves. Just checking in with the Arbitrum version we can see a total of $56b in overall volume, $52m in fees and over 65,000 users. The Arbitrum version of GMX is currently seeing around 1,000 active users per day and roughly 300 new unique traders per day ,which is what some other protocols are seeing in a month.

Tokenomics -

GMX & GLP

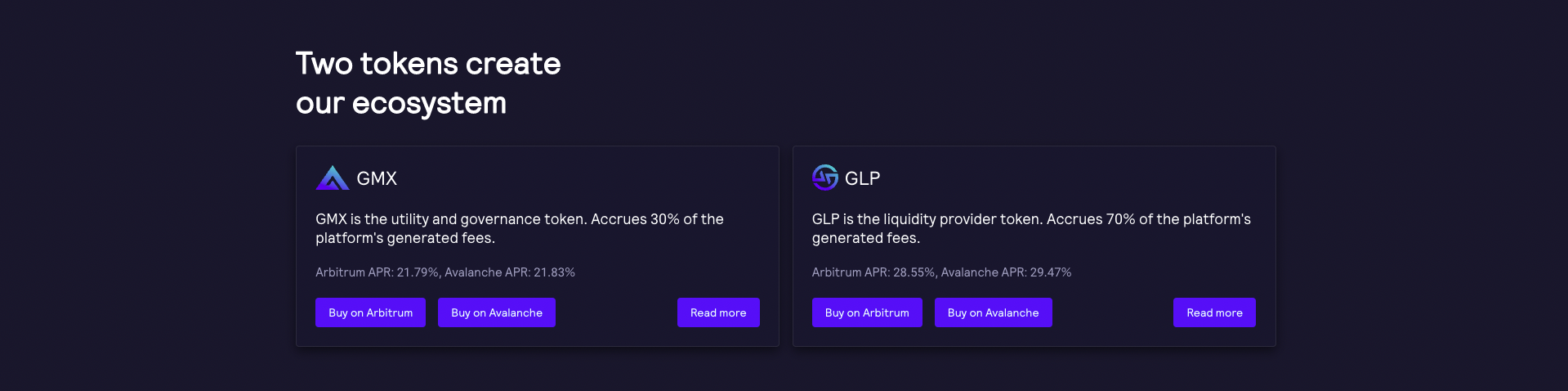

GMX adopts a two-token model with GMX and GLP. GMX acts as a governance token as well as access to the fee sharing model that GMX offers stakers. Rewards are paid in ETH and vested GMX rewards. In our opinion this is one of the most lucrative and sustainable staking models as although some rewards are distributed as esGMX (or vested GMX), the model prevents the sort of farm-and-dump model that we see from low float, high FDV staking models that are designed for short term gain that mainly benefit farmers and farmers only.

GLP acts as a basket of assets that offer liquidity to the GMX platform. Stakers of GLP are exposed to the underlying assets which can include ETH, BTC, LINK and other volatile assets as well as stablecoins. At a very high level this could be compared to Curves 3CRV model where the user deposits any of the basket assets and is then exposed to all three assets (BTC, ETH, USDT) with weights adjusting on the fly. You can think of GLP as a bet on crypto with a high APY yield attached. It’s a method of being exposed to crypto moving up while having downside somewhat muted when you take into account the APY rewarded.

The two-token model GMX has adopted is regarded highly among the community. We recommend diving a little deeper if you’re interested. Check out 0xKeplers GMX Deep Dive linked below.

Tokenomics -

GMX & GLP

GMX adopts a two-token model with GMX and GLP. GMX acts as a governance token as well as access to the fee sharing model that GMX offers stakers. Rewards are paid in ETH and vested GMX rewards. In our opinion this is one of the most lucrative and sustainable staking models as although some rewards are distributed as esGMX (or vested GMX), the model prevents the sort of farm-and-dump model that we see from low float, high FDV staking models that are designed for short term gain that mainly benefit farmers and farmers only.

GLP acts as a basket of assets that offer liquidity to the GMX platform. Stakers of GLP are exposed to the underlying assets which can include ETH, BTC, LINK and other volatile assets as well as stablecoins. At a very high level this could be compared to Curves 3CRV model where the user deposits any of the basket assets and is then exposed to all three assets (BTC, ETH, USDT) with weights adjusting on the fly. You can think of GLP as a bet on crypto with a high APY yield attached. It’s a method of being exposed to crypto moving up while having downside somewhat muted when you take into account the APY rewarded.

The two-token model GMX has adopted is regarded highly among the community. We recommend diving a little deeper if you’re interested. Check out 0xKeplers GMX Deep Dive linked below.

Driving Price -

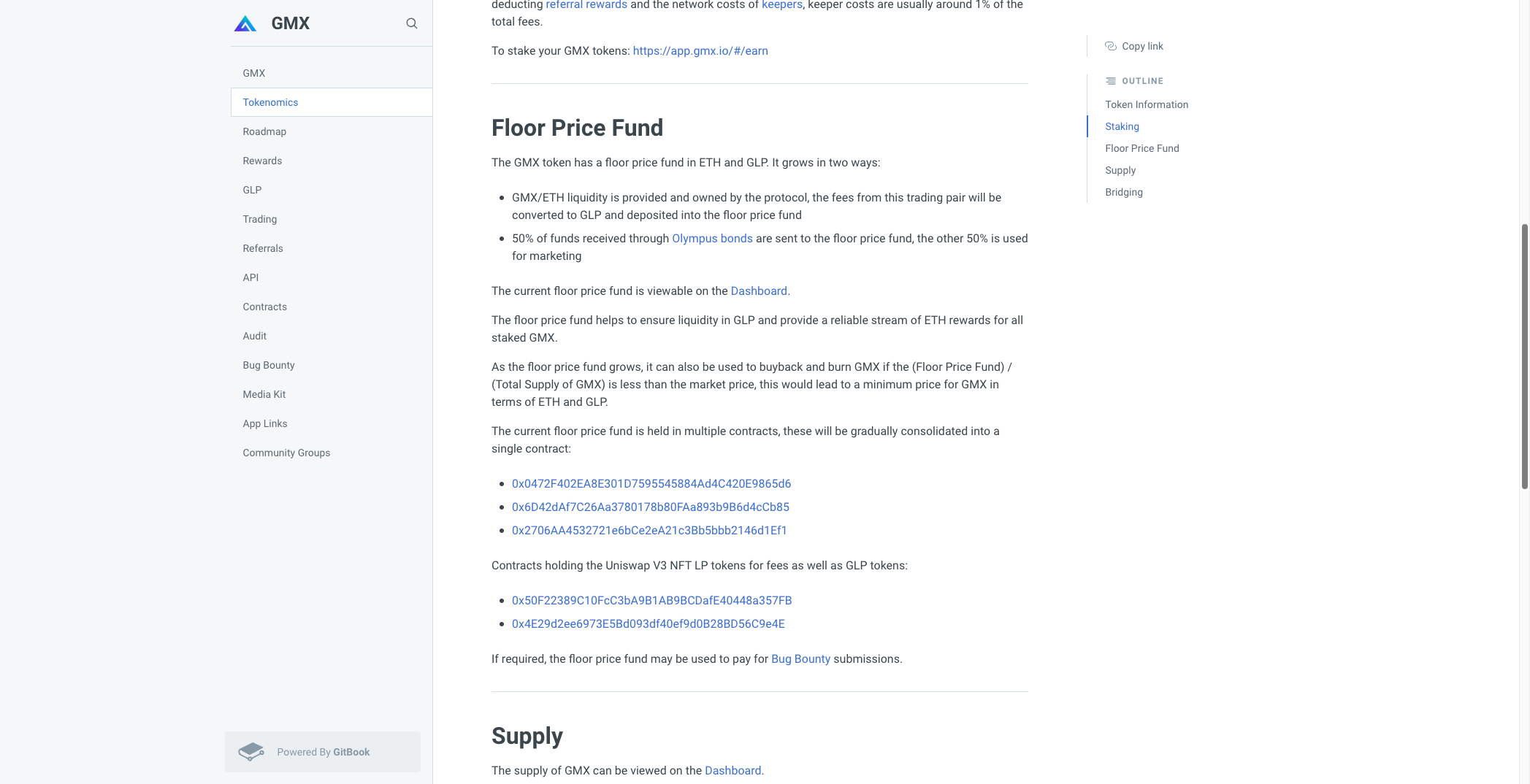

The GMX Floor Price Fund

The GMX Floor Price Fund is essentially a mechanism that utilizes liquidity deposits and GMX buybacks to create an ever rising floor price for the GMX governance token. While not a guarantee of GMX price, it’s a way of incentivising holders to hold strong through market downtrends by providing a provable, trackable view of protocol revenue and profitability.

Right now there are two ways the floor price fund can increase. One way involves fees from GMX/ETH liquidity being deposited into the floor price fund as GLP while the other way involves 50% of funds received through Olympus bonds being sent to the fund. Again, this does not protect GMX from volatility but it does provide holders with confidence that their investment is “protected” by the ever growing pool of cash.

At the time of writing the fund is worth around $3m and this is viewable on the GMX dashboard. The fund can be used to buyback and burn GMX if the floor price fund divided by the total supply of GMX is less than current market price. As long as the floor fund has cash, the GMX token will be bought up when it dips below a certain level.

Sustainability -

Protocol Revenue

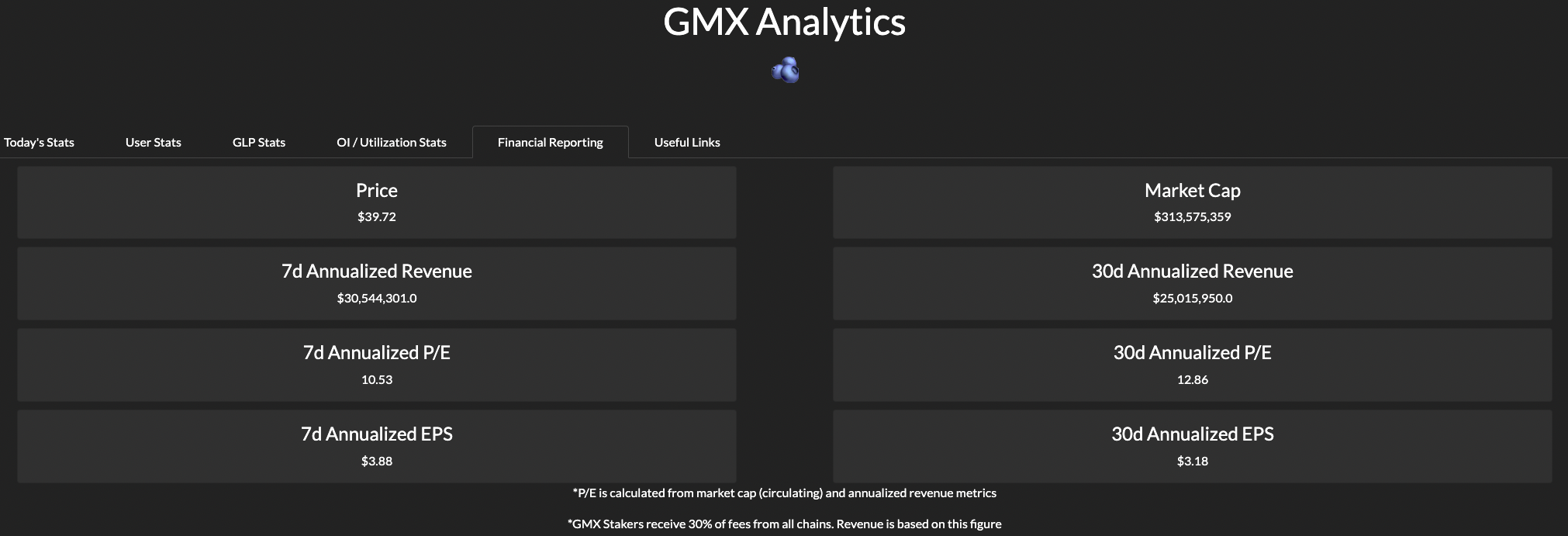

Revenue is where GMX really shines and is no doubt why it’s developed the community and favor of DeFi analysts it has. At the time of writing GMX is pulling a 30d annualized revenue of approx $25m which is extraordinary for a protocol in it’s first year of operation across chains that are still in their growth phases where developers are still trying to grasp what they can do and how they can build a sustainable model.

Bottom line the amount of money coming in from fees on GMX is crazy good. Considering 30% of all fees are going straight to GMX stakers as rewards it’s not hard to understand why the GMX token is getting bid up consistently regardless of overall market conditions. Owning GMX and staking it has definitely been one of the best hedges during the market downturn.

Fees are dynamic but the general expectation is a 0.1% fee for opening and closing positions with additional fees borrowing based on demand. Swap fees are also higher at around 0.25% but again these are dynamic. We recommend checking out either the offical GMX Stats page or the GMX Stats website built by 0xMessi. Links below.

Sustainability -

Protocol Revenue

Revenue is where GMX really shines and is no doubt why it’s developed the community and favor of DeFi analysts it has. At the time of writing GMX is pulling a 30d annualized revenue of approx $25m which is extraordinary for a protocol in it’s first year of operation across chains that are still in their growth phases where developers are still trying to grasp what they can do and how they can build a sustainable model.

Bottom line the amount of money coming in from fees on GMX is crazy good. Considering 30% of all fees are going straight to GMX stakers as rewards it’s not hard to understand why the GMX token is getting bid up consistently regardless of overall market conditions. Owning GMX and staking it has definitely been one of the best hedges during the market downturn.

Fees are dynamic but the general expectation is a 0.1% fee for opening and closing positions with additional fees borrowing based on demand. Swap fees are also higher at around 0.25% but again these are dynamic. We recommend checking out either the offical GMX Stats page or the GMX Stats website built by 0xMessi. Links below.

Networking -

Partnerships & Integrations

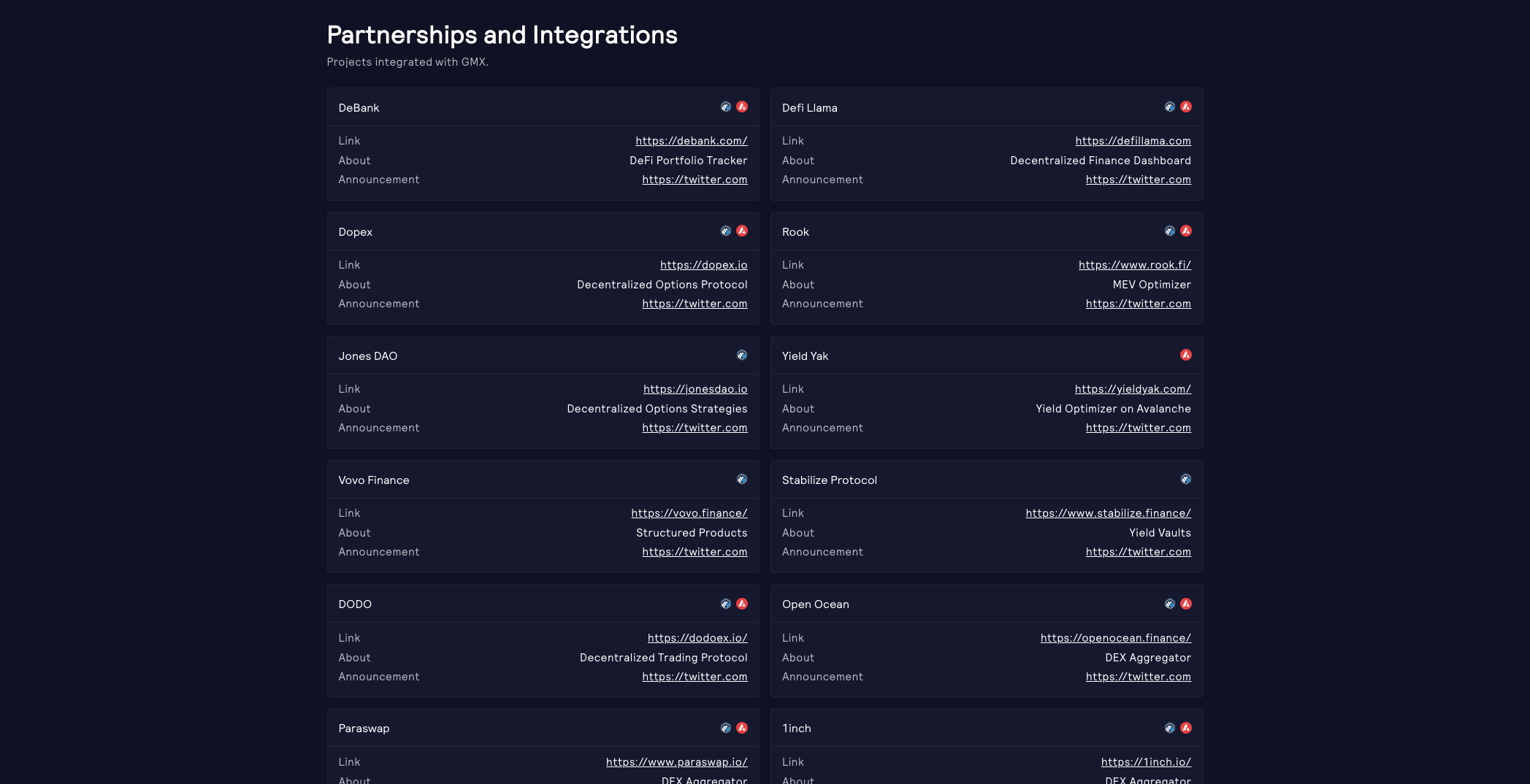

We won’t go into great detail about the partnerships and integrations GMX has been working on over the past year but it’s about what you’d expect from a DEX gearing up for a huge growth phase. We usually see new projects struggle to generate partnerships worth more than a handshake agreement and a few links to each others websites. Not the case for GMX.

In a little under a year, GMX has already made connections with well known protocols like Dopex, Yield Yak, Paraswap, 1inch and Rook. This author may be slightly biased towards their Rook integration which will look to capture arbitrage opportunities and allow for the profits to be redirected to the liquidity pool. GMX has done a great job partnering with projects across the chains in which they operate rather than giving preference towards one or the other.

The partnerships aren’t exactly surprising for a protocol in the DEX space but to see the speed in which these partnerships are developing is pretty exciting. We’ve reviewed many projects that are in their 2nd or 3rd year of operation and only just realizing that they can’t do what they intended to do in-house and are forced to branch out.

Incentivising Growth -

Referral Model

Alright so this is where we shill the ref link. Jokes aside, the GMX referral system is probably the only one that makes sense to traders given the liquidity and volume the GMX platform is dealing with. Many other DEXs have their own referral programs but due to lack of liquidity and volume there’s really no point in participating until the ball starts rolling.

The referral system isn’t dissimilar to a lot of the other CEX programs. A tiered system is in place which prevents self-referrals and offers up to a 10% discount on fees for traders and up to 15% of fees as a rebate to referrers paid in ETH/AVAX depending on the chain, with an additional 5% provided as vested GMX as esGMX. We don’t have exact data on how successful this program has been but given the volume flowing through GMX it’s probably safe to say that referrals have been very impactful thus far.

Feel free to use the link below to get a discount on fees. We’ll include a non-ref link too.

Incentivising Growth -

Referral Model

Alright so this is where we shill the ref link. Jokes aside, the GMX referral system is probably the only one that makes sense to traders given the liquidity and volume the GMX platform is dealing with. Many other DEXs have their own referral programs but due to lack of liquidity and volume there’s really no point in participating until the ball starts rolling.

The referral system isn’t dissimilar to a lot of the other CEX programs. A tiered system is in place which prevents self-referrals and offers up to a 10% discount on fees for traders and up to 15% of fees as a rebate to referrers paid in ETH/AVAX depending on the chain, with an additional 5% provided as vested GMX as esGMX. We don’t have exact data on how successful this program has been but given the volume flowing through GMX it’s probably safe to say that referrals have been very impactful thus far.

Feel free to use the link below to get a discount on fees. We’ll include a non-ref link too.

Summary

GMX stands out as a fine example of a protocol that generates high revenues less than a year into operations. While other DeFi protocols that launched in 2020 are still trying to find product market fit in a constantly evolving sector, GMX very quickly found a model that works for them on a chain that was wide open. It’s hard to say whether GMX would have found the same success on other chains where their may have been direct competition but it’s ultimately an argument that has no meaning. GMX on Abritrum (and now Avalanche) is the place to be if you’re a DEX enthusiast.

More Resources

GMX Website | GMX Stats (Official) | GMX Stats (by 0xMessi) | GMX Deep Dive (by 0xKepler)