ERC20 Token

The Zap platform allows users to create, publish and subscribe to smart contract and Decentralized Application compatible data feeds. Data Speculators can also bond zap for dots and choose to redeem dots.

Smart contracts allow the arbitrary redistribution of crypto capital. The biggest obstacle to the further growth of smart contracts is the need to receive data about the real world. If smart contracts could act based on any arbitrary data, the blockchain could truly encompass all global value. Zap allows data providers to profit from delivering valuable information to the blockchain. Zap allows smart contract developers to leverage real world data on the blockchain.

A few use-cases:

- Insurance – The ZAP store’s data marketplace will provide insurance companies with an opportunity to provide self actuating insurance, that automatically pays customers eligible for a payout. With smart contracts, insurance payouts can be predetermined, streamlining the process for insurers and consumers alike. In this scenario, doctors in a decentralized insurance network would use their private key to sign the smart contract, releasing the funds in order to pay for their service. This is an example of humans acting as oracles.

- Shipping – The magnitude of commerce is enormous. Billions of packages are shipped around the world each year, and yet millions of those packages “disappear” due to factors including inconsistent tracking methods or controls, carelessness, or even outright fraud or theft.Smart contracts can be used to track shipments, inventory and indeed, any economic activity characterized by a process (e.g., construction, assemblage, even large-scale financial reporting).

- Dapps – Currently the only Dapps that are available are those that operate only based on information on the blockchain. These Dapps, while valuable in their own right, have not even begun to scratch the surface of what Ethereum, smart contracts, and Dapps are capable of.In order to make Dapps and smart contracts capable of the feats that are outlined in the Ethereum whitepaper, there needs to be a method of making off-chain information usable by smart contracts. The Zap oracle marketplace is the solution.

“Zap’s objective is to be disruptive, driving change in a wide range of global industries, including finance, insurance, real estate, and shipping. Zap will also find applications in dynamic new distributed application protocols, providing new monetization opportunities for individuals and emerging economies. ”

Positives

- As we’ve said many times before when reviewing projects in this space – Smart Contracts are only as good as the data they’re fed. While other players in this space offer “Oracle solutions”, Zap is in the business of creating the connections from verifiable data to these Oracles, a marketplace where developers/users are rewarded in ZAP tokens for creating and maintaining trustworthy connections. While solutions such as Augur rely on a mass amount of users all agreeing on the result of an event in a decentralized manner, Zap connections grab data from centralized solutions such as mainstream websites (e.g news publications, betting websites, etc). Some may be concerned with the reliance on centralized data sources but with the incentive of ZAP tokens and a rating system, Developers will be interested in keeping these sources up to date and relevant to maintain a good standing.

- The use-cases for the solution Zap offers are endless. If you need to feed a Smart Contract/Oracle with data, you’ll need to grab it from somewhere. Whether it be an integration with a courier to verify package delivery or even an integration with a weather monitoring website to verify an insurance claim on flood damage, if it’s got a human middleman and doesn’t require one, Zap can step in and take the reigns. While Zap doesn’t have absolute direct competitors now, when they do encounter direction competition, there’s literally an endless amount of applications where this technology can be utilized. Plenty of adoption to go around. It’s our belief that Smart Contract Apps and Oracle/Data Feeds will be some of the first technologies to disrupt mainstream applications and solutions. Huge potential for growth on both a small scale and enterprise level.

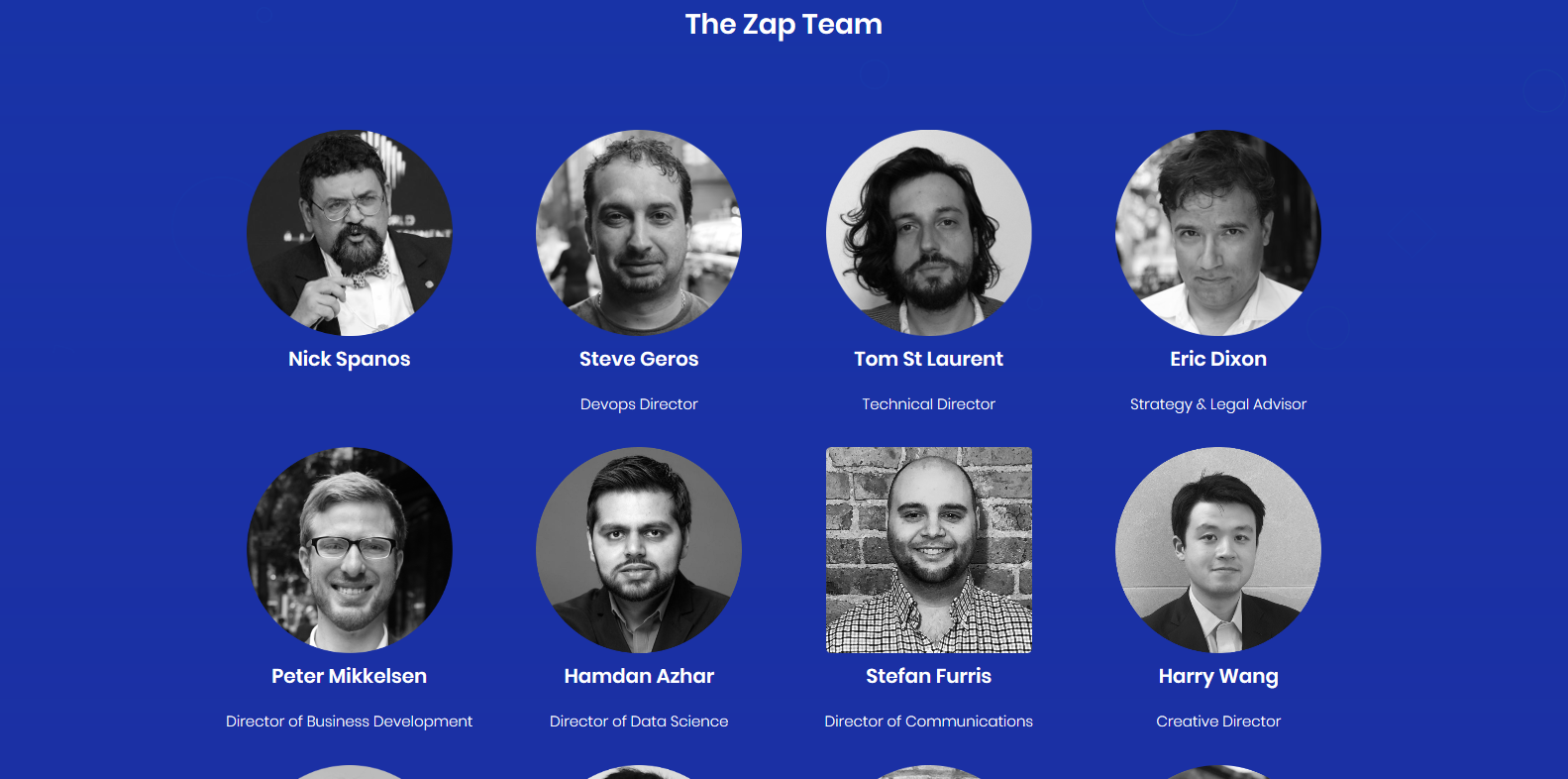

- The Team and Advisory Board behind Zap is very impressive. Being one of the newer solutions to the Oracle scene, it’s being carried in good hands. Led by Nick Spanos (Founder of Zap), an experienced Team of 12 is responsible for everything from development to legal to creative direction. The Team is advised by industry experts who’ve worked in both blockchain tech and have experience in the development of large scale finance/data solutions. The branding of Zap is very user friendly compared to other solutions and the marketing efforts albeit somewhat quiet for now, will no doubt carry a lot more impact with a catchy name and a memorable token ticker (ZAP). We’re excited to see what the Team can achieve in 2019 as it’ll no doubt be a big growth/adoption phase.

- For a relatively new project in the niche of Oracle/Data Feed solutions, Zap has a working, albeit fairly bare-bones solution available for use right now. Using Metamask, you can check the platform out for yourself, they’ve even got full SDK and Documentation available. If you’re not a developer and just want to see the product in action, check out the Oracle Marketplace and Oracle Wallet. While other solutions are working behind the scenes often at a slower pace with often minimal updates for investors, Zap is clearly ready to show off what the platform can do. We’ve criticized other platforms for being very “behind the curtains” where investors aren’t really getting to see a hands-on product, Zap definitely stands out here as a well established, easy to navigate product.

- There is plenty to be excited about when you take the time to research Zap. Not only is the platform progressing at a great pace, it’s a micro-cap project compared to other projects in the space. From an investors point of view, the ROI is extraordinary if the market capitalization of ZAP were to reach the height of its competitors. At the time of writing (March 2019) volume is somewhat low due to exchange issues (looking at you Cryptopia), but with more exchanges no doubt coming in the future you can expect awareness of ZAP to increase as liquidity increases. As with any emerging technology aiming to disrupt centralized solutions, give this one time. A very undervalued project in our eyes.

Concerns

- The main concern here is relevant to a ton of projects that are preparing for the future of Smart Contracts – the race to adoption. With competitors (albeit not direct) in the space such as Oracalize and Chainlink, Zap is the new kid on the block, but it’s not necessarily a bad thing. Zap has the advantage of offering a slightly different but just as important solution to the Oracle/Smart Contract space. Oracles are only as good as the data being fed to them and those feeds don’t just create themselves. Developers looking to monetize their skills and provide accurate data to Oracles, albeit from mostly centralized sources, will not only have an incentive to create these feeds but to keep them accurate and up to date at the risk of being rated poorly on the platform. Chainlink and Oracalize are big players in this space but are they a direct competitor to Zap? No, as long as you look behind the front cover. Until Oracles are used on a much larger scale, it’s easy for Zap to be thrown in with the bunch despite being fundamentally different. It’ll take some time for Zap to properly differentiate itself as adoption of this niche grows.

- While Zap offers a different solution to competitors such as Chainlink, there’s technically nothing stopping these competitors creating their own Marketplaces where developers/users can provide data feeds for a fee. Zap offers a solution that fills a gap in the connection between real-world data and Oracles, but as with any niche, there will be competition in the future. Let’s hope some of the leaders in this space aren’t the ones to bring in a similar solution.

- No other concerns. Certainly no red flags. At the time of writing (March 2019), the Roadmap for the remainder of 2019 isn’t too detailed. Not that it’s incredibly important but we’re also yet to see any partnerships or applications taking advantage of Zap just yet although the platform is still relatively new so this could be a few months away. It’s worth noting again that the platform is fully live and ready to go, it’s just a matter of time before we see the platform spread its wings. A few minor things: Some sections of the admin panel are still unavailable and cannot be accessed, but should tell you that the Team is still building and refining things before deploying those features. Some more marketing would be great but that should only come when ready. That’s it. A long term hold for sure.

View Screenshots

Token Details

Token Type

ERC20

Powered by the Ethereum Network. Can be stored on any ERC20 compatible wallet e.g MyEtherWallet

Token Statistics

Supply

• Ticker: ZAP

• Circulating Supply: 131,534,257

• Total Supply: 520,000,000

• Token Use: Services & Fees

Founders

The Team

• Nick Spanos (Founder)

• Steve Geros (Devops Director)

• Tom St Laurent (Tech Director)

• More

Industry

& Competitors

• Data Oracles

• Smart Contracts

• Competitors – No Direct Competitors.