Creditcoin Price Prediction

Methods To Predict The Price Of Creditcoin (CTC)

Getting Started -

Creditcoin (CTC) Price Prediction

Creditcoin experiences high volatility just like any other cryptocurrency which is why it’s useful to be able to predict the price of CTC and trade accordingly. Today we’ll be looking at how you can use methods such as technical and fundamental analysis to formulate your own Creditcoin price prediction

Let’s take a look at some commons questions regarding the price of Creditcoin (CTC)

- Creditcoin Price Prediction For 2022

- Creditcoin Price Prediction For 2023-2025

- Is Creditcoin (CTC) A Good Investment?

- Creditcoin Price Prediction Through Technical Analysis

- Creditcoin Price Prediction Through Fundamental Analysis

If you’re unfamiliar with Creditcoin (CTC), follow the links below to learn more.

Analyzing Price -

Analyzing The Price Of Creditcoin (CTC)

One of the simplest methods to predict the future price of a cryptocurrency like Creditcoin (CTC) is by looking at prior price history on a chart. Through the use of common technical analysis techniques such as identifying horizontal support and resistance levels, calculating moving averages and calling on indicators to signal strength or weakness in the market we can summarize a CTC price prediction from the tools that are freely available online.

The large majority of popular cryptocurrencies are available to chart and analyze on TradingView. TradingView integrates with popular exchanges like Binance, Huobi, ByBit, Kucoin and many more to offer real-time price data on a wide range of Altcoins such as Creditcoin (CTC).

Analyzing Price -

Analyzing The Price Of Creditcoin (CTC)

One of the simplest methods to predict the future price of a cryptocurrency like Creditcoin (CTC) is by looking at prior price history on a chart. Through the use of common technical analysis techniques such as identifying horizontal support and resistance levels, calculating moving averages and calling on indicators to signal strength or weakness in the market we can summarize a CTC price prediction from the tools that are freely available online.

The large majority of popular cryptocurrencies are available to chart and analyze on TradingView. TradingView integrates with popular exchanges like Binance, Huobi, ByBit, Kucoin and many more to offer real-time price data on a wide range of Altcoins such as Creditcoin (CTC).

Technical Analysis -

Identifying Support & Resistance Levels

Identifying levels of support and resistance are often all it takes to start creating a CTC price prediction, at least in the short to mid-term. Horizontal resistance levels can be identified by counting the amount of times a price is tested and rejected on an attempt upwards. Horizontal support levels can be identified by counting the amount of times a a price tests and bounces from a particular price on the way down. Predicting the price of CTC can also be useful for determining sell targets if you’re already holding CTC and wondering where to sell for the highest profit.

In the following chart we can see that price has had many interactions with the areas marked in yellow, specifically at points marked by green arrows. Seeing as price has interacted with these marked areas many times in the past, Traders can use these areas in which to setup buy or sell orders depending on what they believe will happen. From this data you may be able to create your own CTC price prediction and trade accordingly.

Technical Analysis -

Using Moving Averages

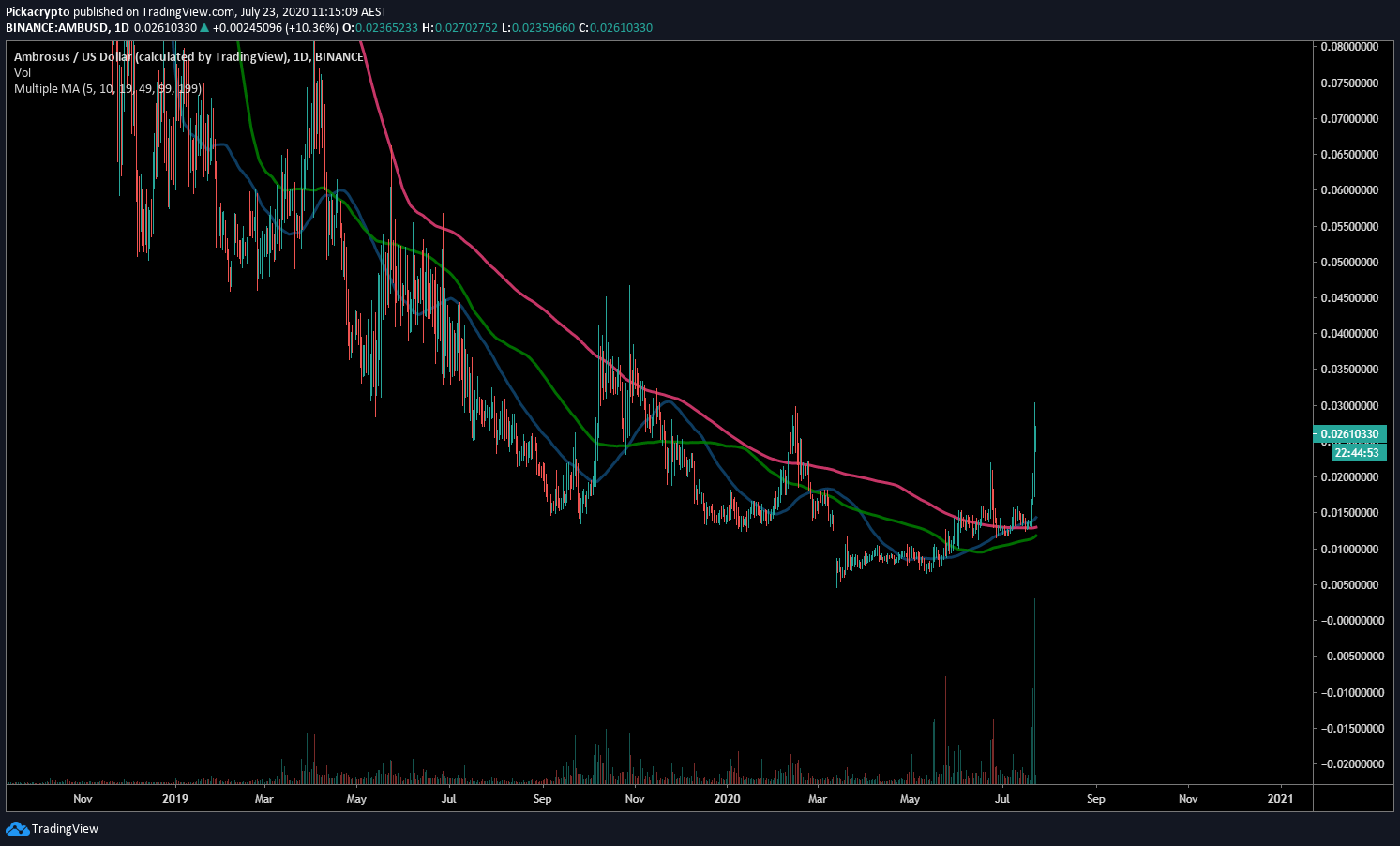

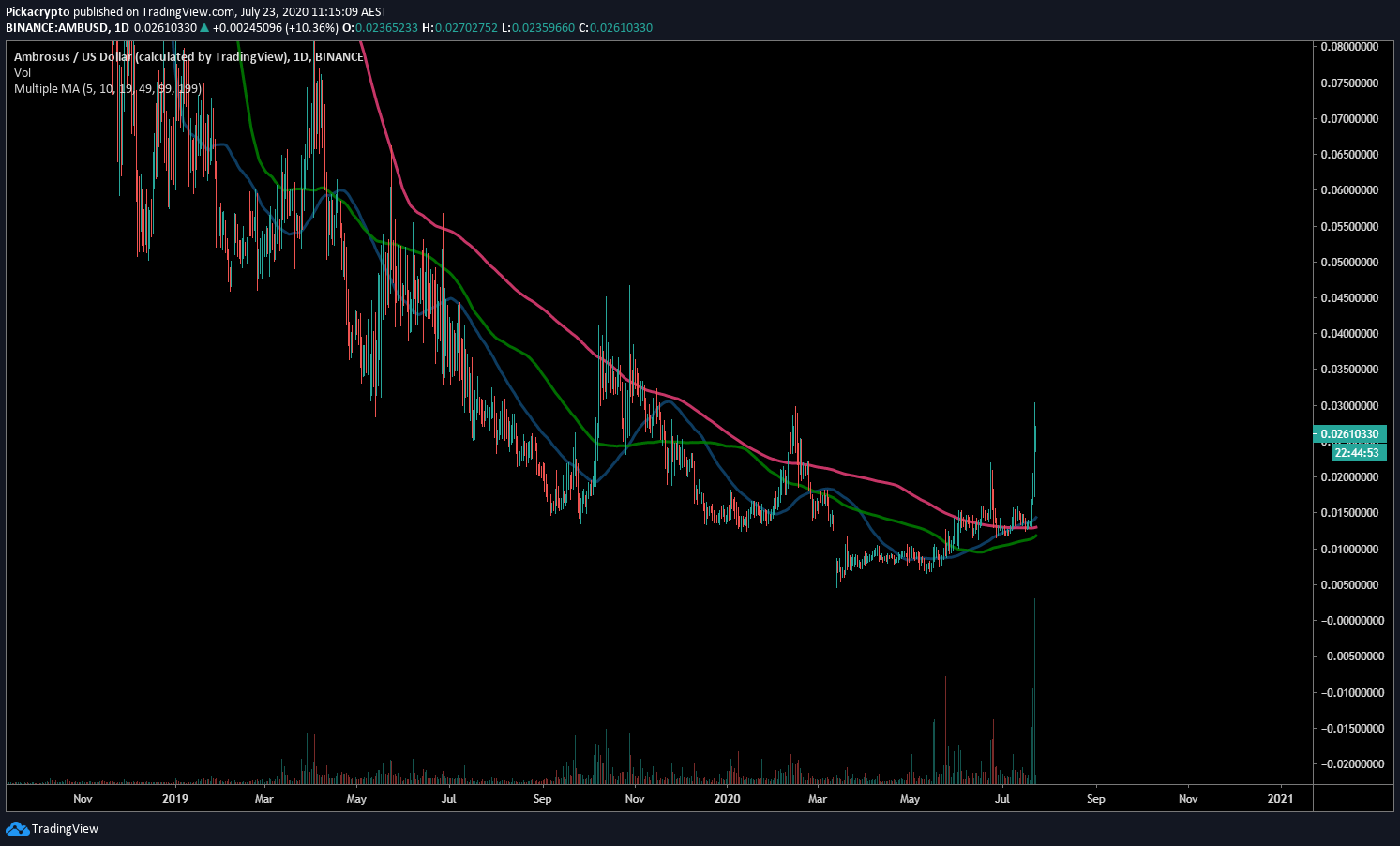

Creating a Creditcoin price prediction can also involve Moving Averages or “MA’s”. Moving averages are used by many Traders to assess momentum and potential levels where price is likely to bounce from a downtrend or start slowing down after an uptrend. With the use of several important moving averages such as the 20, 50, 100 and 200, Traders can get a good idea of when to buy Creditcoin (CTC) and when to sell for profit.

In the following image we can see that price has had several interactions with the 1D 200MA which is represented by the pink line running through the chart. From this we can assume that this line will remain important in determining the price of an asset like Creditcoin and creating a short, mid and even long term Creditcoin price prediction.

For long term investing or trading, look at moving averages on the daily or weekly charts for important levels in which to form your Creditcoin (CTC) price prediction.

Technical Analysis -

Using Moving Averages

Creating a Creditcoin price prediction can also involve Moving Averages or “MA’s”. Moving averages are used by many Traders to assess momentum and potential levels where price is likely to bounce from a downtrend or start slowing down after an uptrend. With the use of several important moving averages such as the 20, 50, 100 and 200, Traders can get a good idea of when to buy Creditcoin (CTC) and when to sell for profit.

In the following image we can see that price has had several interactions with the 1D 200MA which is represented by the pink line running through the chart. From this we can assume that this line will remain important in determining the price of an asset like Creditcoin and creating a short, mid and even long term Creditcoin price prediction.

For long term investing or trading, look at moving averages on the daily or weekly charts for important levels in which to form your Creditcoin (CTC) price prediction.

Technical Analysis -

Utilizing Indicators

Indicators can assist Traders in making a prediction on whether the price of Creditcoin (CTC) will go up or down. Indicators take into account various factors such as time, volume, momentum and many more to indicate whether a cryptocurrency like Creditcoin (CTC) may rise or fall. Although they’re unable to predict the price of CTC, they’re able to indicate trends and strength

In the following image we can see that the RSI (Relative Strength Index) Indicator which is used by a large majority of Traders is located at the bottom of the chart. The areas above and below the dotted lines indicate whether a coin like Creditcoin (CTC) is overbought or oversold. The RSI takes into account prior price action and volume to indicate whether there is a shift from buying to selling or selling to buying.

We’ve highlighted four different occasions where a coin has been overbought or oversold which quickly resulted in a change in overall trend.

Fundamental Analysis -

Assessing Strengths & Weaknesses

Another way to make a Creditcoin (CTC) price prediction is by assessing what the project has accomplished or plans to accomplish in the near future. Keeping up to date with Creditcoin (CTC) news and planning the buy or sell Creditcoin (CTC) around key events is a method long term Traders use consistently.

While technical analysis may assist Traders in deciding when to buy or sell Creditcoin (CTC), fundamental analysis can often help forecast future CTC price based on the knowledge of upcoming notable events or breaking news which may have an immediate and unexpected affect on price, regardless of what the charts show.

Keeping up to date with important Creditcoin (CTC) news will give Traders an edge where technical analysis falls short.

Fundamental Analysis -

Assessing Strengths & Weaknesses

Another way to make a Creditcoin (CTC) price prediction is by assessing what the project has accomplished or plans to accomplish in the near future. Keeping up to date with Creditcoin (CTC) news and planning the buy or sell Creditcoin (CTC) around key events is a method long term Traders use consistently.

While technical analysis may assist Traders in deciding when to buy or sell Creditcoin (CTC), fundamental analysis can often help forecast future CTC price based on the knowledge of upcoming notable events or breaking news which may have an immediate and unexpected affect on price, regardless of what the charts show.

Keeping up to date with important Creditcoin (CTC) news will give Traders an edge where technical analysis falls short.

Creditcoin In 2022 -

Creditcoin (CTC) Price Prediction For 2022

Using support/resistance, trendlines, moving averages and simple indicators like the RSI, you can create a reasonably accurate Creditcoin price prediction for 3, 6 and 12 months ahead of time. We think that price could reach somewhere around the $3 – $10 USD mark in the next few months.

Fundamental analysis should be a part of your analysis when creating your own Creditcoin price prediction. Researching what the Creditcoin Team is doing in the next few months can help you determine whether or not an investment will be profitable after certain events, roadmap goals or milestones are met. Technical analysis holds more weight against fundamental analysis in determining short term CTC price movements but it’s important to acknowledge upcoming events in the coming weeks and months.

Through current trends, Investor sentiment and the overall direction of the cryptocurrency market, we think Creditcoin (CTC) has a good chance of visiting the $3 – $10 USD mark in 2022 as long as the trend continues and the Team continues to work on their products and partnerships.

Creditcoin In 2023 - 2025 -

Creditcoin Price Prediction For 2023 - 2025

From 2023 to 2025 we think the price of CTC to visit the $15 – $80 USD area as the Team continues to develop their products and those products receive adoption from the target audience. This CTC price prediction is based on several data sets and predictive modelling which assumes the current long term trend driving the price of CTC continues in an upwards direction with no major setbacks.

Fundamental analysis of Creditcoin is crucial when predicting the price of the CTC token in the long term. Long term trends determined by technical analysis from years of historic price data will assist in predicting the years ahead, but fundamental analysis is key. You’ll need to keep track of newsletters, social media, upcoming events, overall Investor sentiment and market conditions as they change over time to determine when to buy or sell at the right time. Creating a Creditcoin price prediction from collated data is an overall useful step in determining whether a long term investment is expected to be profitable.

Using prior price data, predictive modelling and Investor sentiment scraped from various sources online, a Creditcoin (CTC) price prediction of around $15 – $80 USD is what our data shows could be possible in 2023-2025 given the fundamentals of Creditcoin and prior price data of the CTC token.

Creditcoin Price Prediction For 2023 - 2025

CTC Price Prediction For 2023 - 2025

From 2023 to 2025 we think the price of CTC to visit the $15 – $80 USD area as the Team continues to develop their products and those products receive adoption from the target audience. This CTC price prediction is based on several data sets and predictive modelling which assumes the current long term trend driving the price of CTC continues in an upwards direction with no major setbacks.

Fundamental analysis of Creditcoin is crucial when predicting the price of the CTC token in the long term. Long term trends determined by technical analysis from years of historic price data will assist in predicting the years ahead, but fundamental analysis is key. You’ll need to keep track of newsletters, social media, upcoming events, overall Investor sentiment and market conditions as they change over time to determine when to buy or sell at the right time. Creating a Creditcoin price prediction from collated data is an overall useful step in determining whether a long term investment is expected to be profitable.

Using prior price data, predictive modelling and Investor sentiment scraped from various sources online, a Creditcoin (CTC) price prediction of around $15 – $80 USD is what our data shows could be possible in 2023-2025 given the fundamentals of Creditcoin and prior price data of the CTC token.

Creditcoin (CTC) Price Prediction -

Is Creditcoin (CTC) A Good Investment?

When deciding on if Creditcoin (CTC) is a good investment for you, taking into account risk and reward is crucial. We can predict the price of CTC both in the short term and long term, but expectations need to be reasonable for each. Long term we think CTC will appreciate based on the fundamentals of the Creditcoin project and the progress the Team is making towards their roadmap goals and milestones.

By using Technical Analysis we are able to predict what the price of CTC may be in the short term and calculate our investment sizes accordingly. Using horizontal resistance and support levels, moving averages, various indicators and other techniques, you can make an educated price prediction on whether the price will go up or down in the next few days, weeks and months.

The cryptocurrency market is extremely volatile and hard to predict in the long term so researching the fundamentals and progress of Creditcoin is an essential task before deciding to invest any amount of funds for the long term with the aim of holding for months or years. When analyzing the price of Creditcoin to form a price prediction for the short or long term, taking both technical and fundamental analysis into account is essential.

Those Are The Tools

Join TradingView and make your own Creditcoin (CTC) price prediction today

More Resources