ERC20 Token

Credits is an open blockchain. The platform is designed to create services for blockchain systems using self-executing smart contracts with a public data registry. A unique technological platform for the development and execution of decentralized applications based on the blockchain technology and smart contracts

Credits technology far exceeds competition because of its performance characteristics, availability of flexible customizable smart contracts and its own internal currency (CS)

- Decentralized Data – Credits allows for the disclosure of transaction data to all interacting parties while maintaining anonymity.

Storing data in a redundant and non-modified blockchain will protect against fraud. - Smart Contracts – Automation of asset management within the blockchain network by means of self-executable programs of unlimited complexity.

A unique tool for creating and managing contracts. - Issuance of Financial Assets – Issuance of various financial assets on the blockchain: bonds, obligations, letters of credit, shares, certificates, cryptocurrencies, derivatives, tokens, etc. Crowdfunding and ICO. Payments and internal cryptocurrency.

“Credits is an open blockchain platform with autonomous smart contracts and an internal cryptocurrency. The platform is designed to create services for blockchain systems using self-executing smart contracts with a public data registry.”

Exchanges

Positives

- Credits is entering a space that already has a lot of competition, but it’s not entering it without its fair share of unique features/technology. Credits boasts transaction speeds of “Around 0.1 seconds”, fees of “around 0.001 USD” and “millions of transactions per second”. Of course these numbers kick the behind of current leaders such as Ethereum and NEO but we do have to keep in mind the real-world testing that has to be done to confirm these numbers – they’re all theoretical at this time, although tests have been performed successfully.

- Credits looks like it’s aiming to be an all-in-one solution for a lot of sectors. Decentralized Data, Smart Contracts, Issuance of Financial Assets and Crypto Payments are all listed as solutions on Credits Website. If they can handle all of these avenues properly and market their product to the right investors, they’ll potential solve issues that projects are solely focusing on. In simple terms, if Credits is successful, they have the potential to provide solutions that other projects are trying to solve, capturing a share of each of those markets and potential stealing the spotlight in these areas.

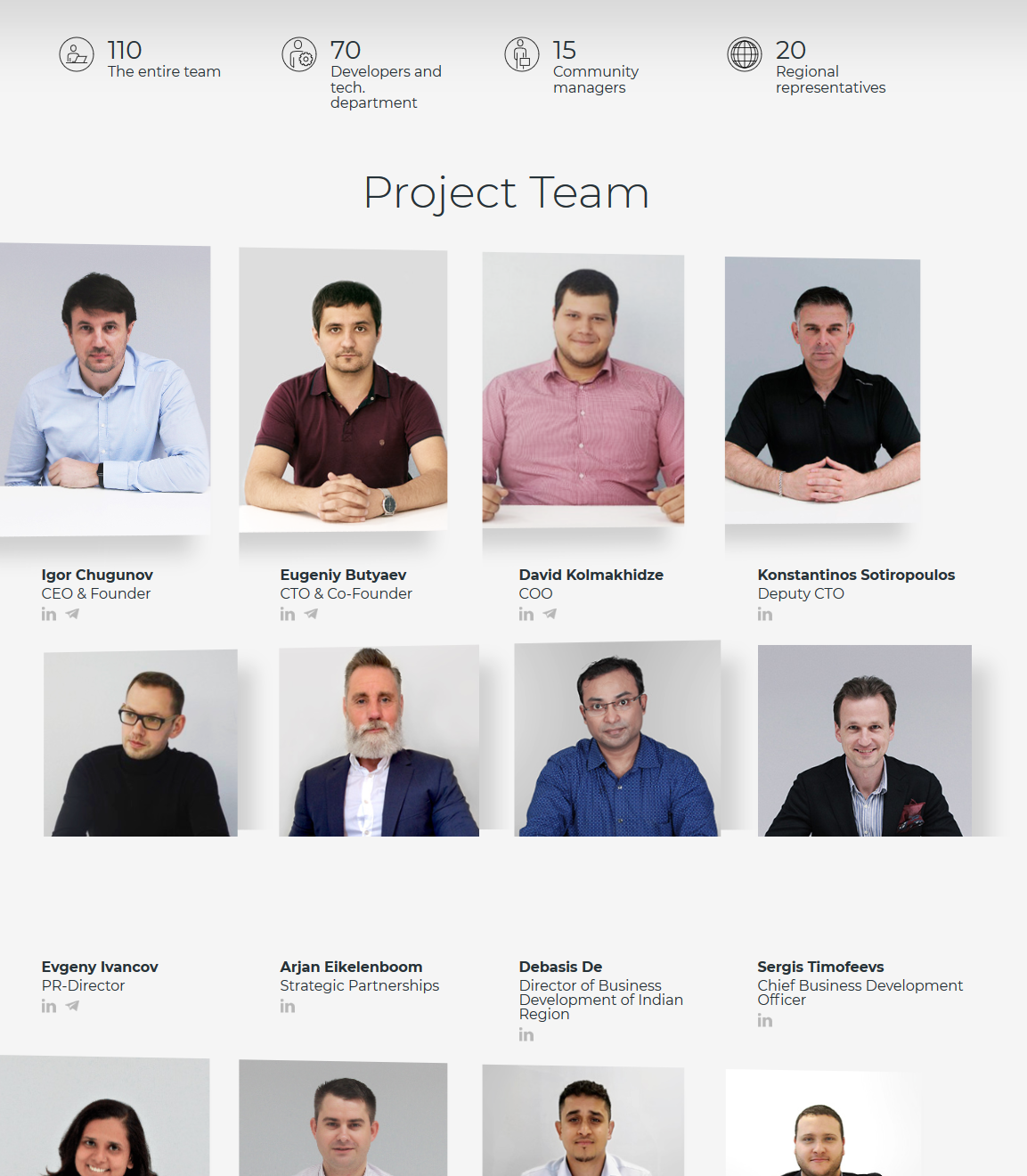

- Credits boasts one of the biggest teams we’ve seen working on a blockchain project which is pretty impressive. What is even more impressive is the roles that the team has covered to ensure a well structured business model. The team of 110 is comprised of 70 Developers/Tech, 15 community managers and 20 regional representatives. One of the little things we noticed was that the Team is pictured at what looks to be the same table (here), it’s not really a big deal to most but this means that the team has at least met/worked with each other. We have seen SO many projects with Team photos that look like they were simply sent in through an iMessage/Text from several different locations, it’s always refreshing to see Team Members presented like this.

- From an investors standpoint, Credits is looking like a pretty good opportunity to invest in a potential competitor to current leaders such as Ethereum and NEO. With a Market Cap of $33 Million USD at the time of writing (July 30th, 2018), the upside potential here is huge when you compare these numbers to that of current leaders. A wide range of solutions can be offered here and the Market Cap will definitely reflect this if Credits can garner adoption.

Concerns

- Not a huge amount of concerns for Credits from our point of view. Small things here and there that will surely figure themselves out. For instance a lot of the partnerships that Credits boasts are partnerships with blockchain projects that are still trying to prove themselves. Projects such as Sparkster, Pillar and several other albeit well known names are still trying to develop their own platforms. These “Partnerships” could simply be two projects exploring potential solutions, especially for those platforms that aren’t fully developed yet with no solution to offer “right now”. In saying that, partnerships with already established organizations such as Smedegaard and the University of Nicosia among other partners are pretty solid and a great sign of networking ability.

- Obviously we need to see Credits put under some heavy load to be able to verify their claims of being able to process “Millions of transactions per second”. The technology is there and in theory these numbers are achievable but until there is an actual need for 1 Million TPS or stress tests of this capacity are performed, it’s all theoretical scalability. It’s worth noting that Credits are not the only platform with theoretical statistics such as these, this is not a direct concern for Credits but rather something people should keep in mind to stay grounded.

- Roadmaps and Github activity are something we take a look at but shouldn’t be the only way to gauge development progress. In saying that, at the time of writing (July 30th, 2018) Credits’ Github is still in it’s early days in terms of commits and somewhat inactive when considering their team is supposedly includes 70 Developers. Now, this is assuming all of Credits’ Github activity is public, it is entirely possible that they are developing more features/code privately to protect their ideas/progress. A minor concern but something to keep an eye on.

View Screenshots

Token Details

Token Type

ERC20

Powered by the Ethereum Network. Can be stored on any ERC20 compatible wallet e.g MyEtherWallet (Tokens will be eventually be swapped to MainNet CS tokens.)

Token Statistics

Supply

• Ticker: CS

• Total Supply: 249,471,071

• Circulating Supply: 138,268,126

• Token Use: Services & Fees

Founders

The Team

• Igor Chugunov (CEO/Founder)

• Eugeniy Butyaev (CTO)

• David Kolmakhidze (COO)

• More

Industry

& Competitors

• Decentralized Applications

• Blockchain Platform

• Competitors – Ethereum, Neo, Lisk, Etc