How To Buy Ethverse (ETHV) On Uniswap

A Step-by-Step Guide

Step 1 -

Create A Metamask to Buy ETHV on Uniswap

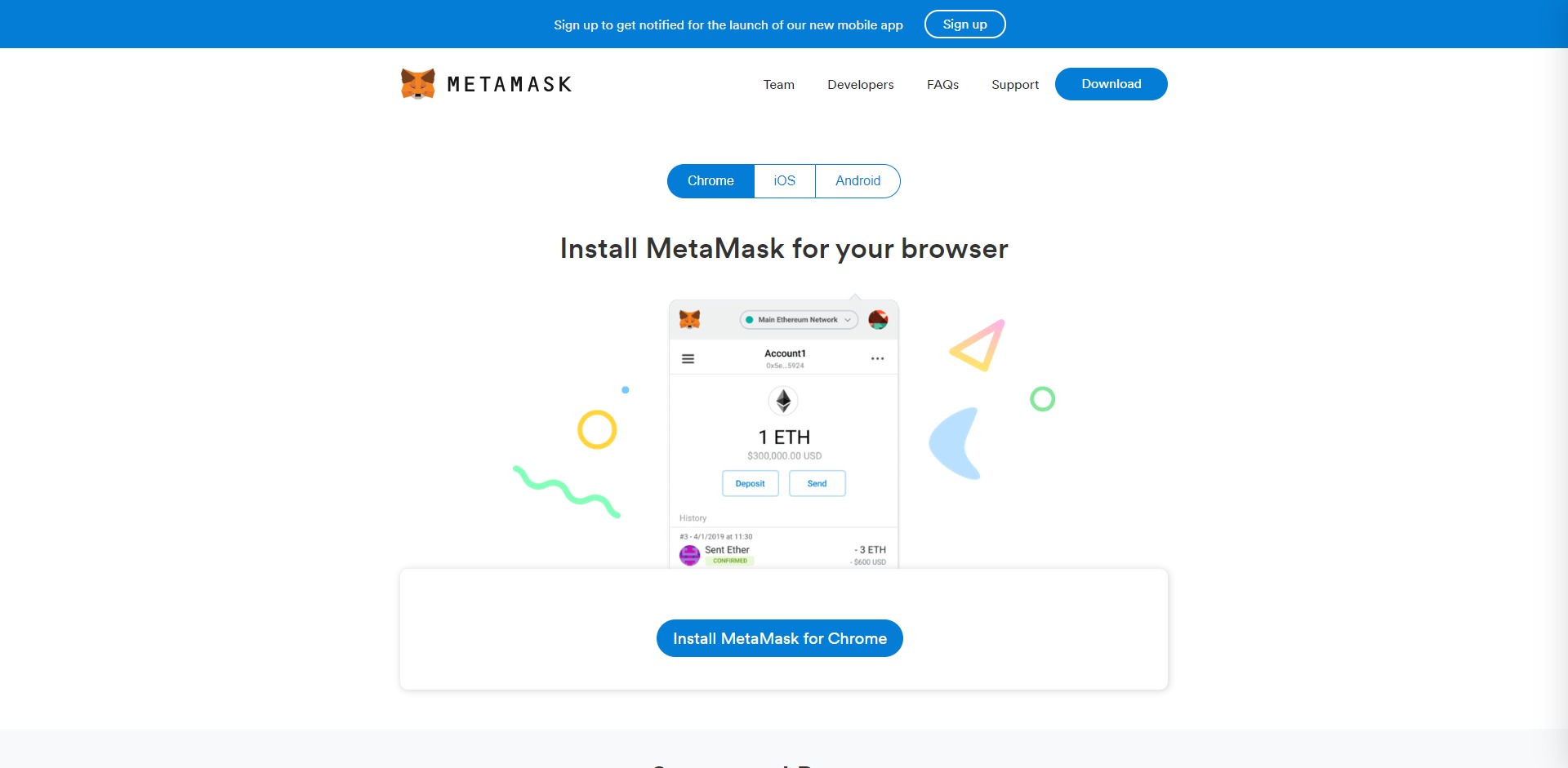

In order to buy Ethverse (ETHV), you’ll first need to Create a Metamask wallet. Metamask is browser tool that allows you to interact with various decentralized applications such as Uniswap, without the need to login to third-party services to perform simple actions. Ethverse ETHV is available on Uniswap, an exchange that is gaining popularity as interest in DeFi (decentralized finance) rockets higher and higher. Uniswap is decentralized and therefore allows users to interact with it directly from their wallet. Metamask is simply the tool that allows you to gain access to Uniswap in order to buy Ethverse (ETHV).

The buttons below will take you to learn more about either Metamask and Uniswap.

Step 2 -

Connect To Uniswap To Buy Ethverse (ETHV)

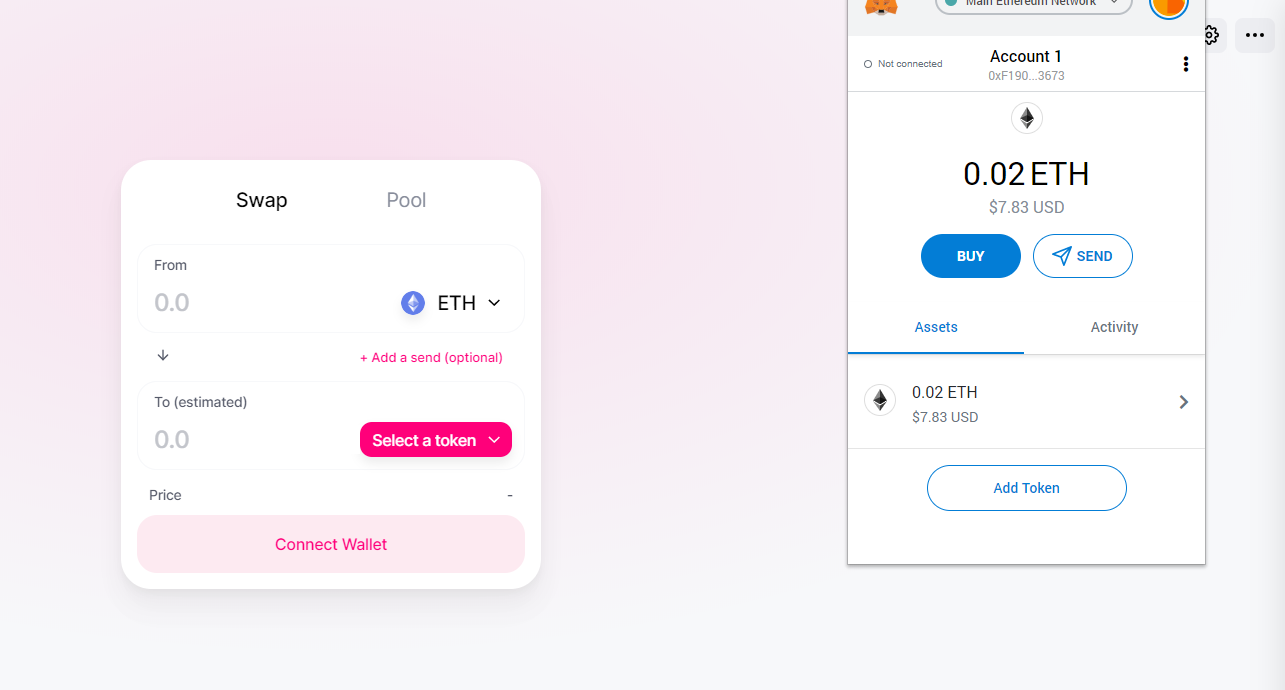

With a Metamask Wallet setup, you can now buy ETHV tokens after you’ve deposited your desired amount of Ethereum (ETH) or any other token you’d like to “swap” for Ethverse ETHV tokens into your Metamask address. Ethereum is the most popular currency on Uniswap, so we’ll use that. Head over to the Uniswap App when you’re ready to get started. Ethverse (ETHV) tokens can be found by clicking the “Select a token” button highlighted in the screenshot provided. You can either locate Ethverse (ETHV) via the dropdown box or enter the contract address directly.

If the token you’re looking to purchase isn’t located in the dropdown box, entering the contract address for that token is the only alternate way of purchasing. The contract address for Ethverse (ETHV) is 0xeeeeeeeee2af8d0e1940679860398308e0ef24d6. It’s important to verify the contract address with the team directly if you’re able to get in touch with them, as entering the wrong address could result in the loss of funds. We’ve taken the available steps to verify the contract address in this example.

Once you’ve chosen Ethverse (ETHV) from the dropdown or via input of the contract address, you’ll now be able to initiate a swap.

Step 2 -

Connect To Uniswap To Buy Ethverse (ETHV)

With a Metamask Wallet setup, you can now buy ETHV tokens after you’ve deposited your desired amount of Ethereum (ETH) or any other token you’d like to “swap” for Ethverse ETHV tokens into your Metamask address. Ethereum is the most popular currency on Uniswap, so we’ll use that. Head over to the Uniswap App when you’re ready to get started. Ethverse (ETHV) tokens can be found by clicking the “Select a token” button highlighted in the screenshot provided. You can either locate Ethverse (ETHV) via the dropdown box or enter the contract address directly.

If the token you’re looking to purchase isn’t located in the dropdown box, entering the contract address for that token is the only alternate way of purchasing. The contract address for Ethverse (ETHV) is 0xeeeeeeeee2af8d0e1940679860398308e0ef24d6. It’s important to verify the contract address with the team directly if you’re able to get in touch with them, as entering the wrong address could result in the loss of funds. We’ve taken the available steps to verify the contract address in this example.

Once you’ve chosen Ethverse (ETHV) from the dropdown or via input of the contract address, you’ll now be able to initiate a swap.

Step 3 -

Buying Ethverse (ETHV) On Uniswap

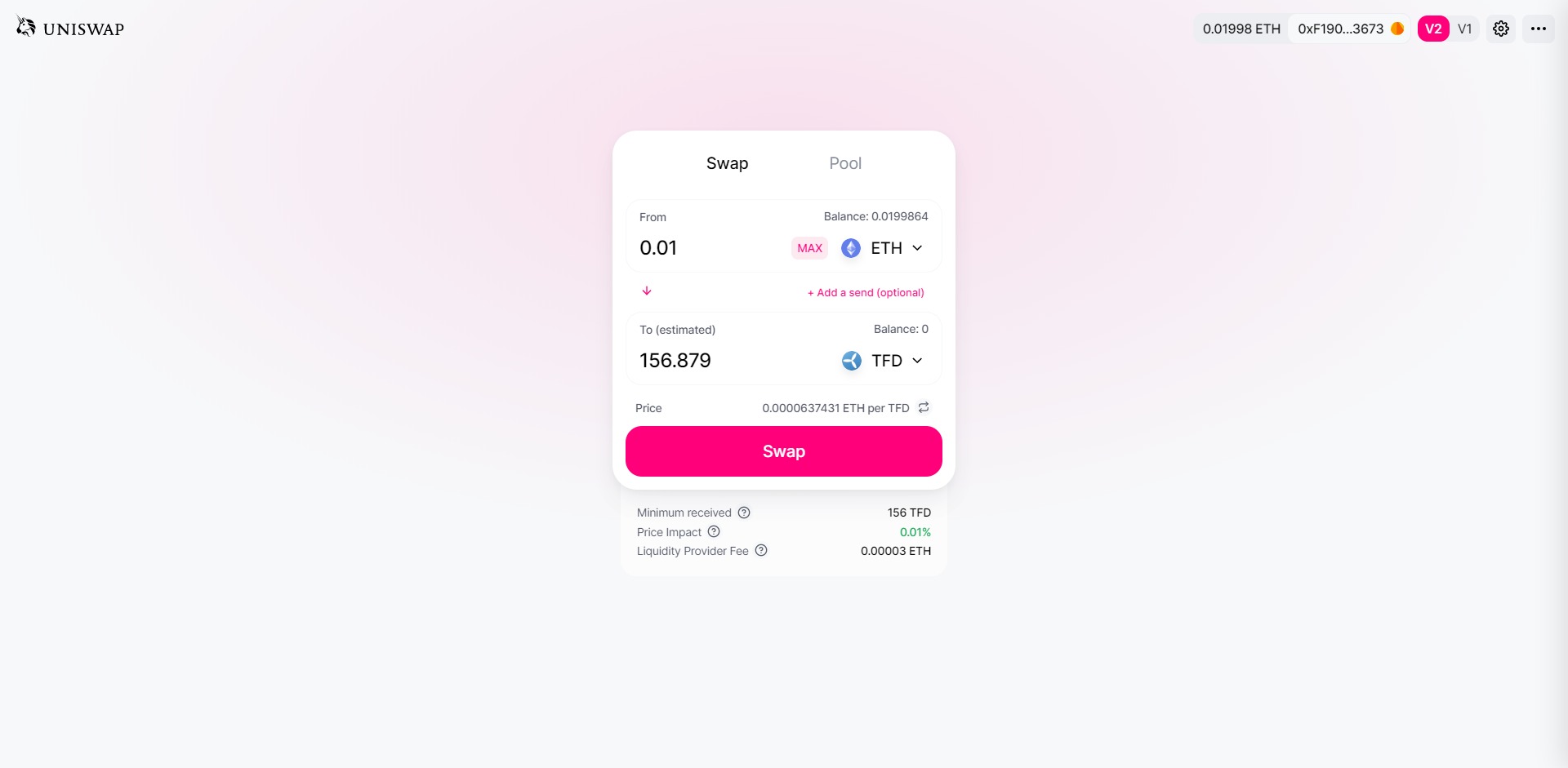

Because Uniswap is a decentralized exchange similar to IDEX, Etherdelta, etc, there are a few steps you need to take to make sure you understand the process of swapping ETH for ETHV.

Before clicking “Swap”, take into account the “Minimum received”, “Price Impact” and “Liquidity Provider Fee” fields in order to make sure you perform the cleanest transaction with minimal impact to liquidity or unnecessary loss of your own funds due to fees, etc.

In the example shown in the image provided using TFD as an example, we can see that the “Minimum received” field is showing an amount similar to what we were quoted above, the “Price Impact” field indicates that our purchase will incur minimal impact to the price of the token and the “Liquidity Provider Fee” is reasonable for the size of our transaction. We can now hit “Swap” to buy Ethverse (ETHV).

Step 3 -

Buying Ethverse (ETHV) On Uniswap

Because Uniswap is a decentralized exchange similar to IDEX, Etherdelta, etc, there are a few steps you need to take to make sure you understand the process of swapping ETH for ETHV.

Before clicking “Swap”, take into account the “Minimum received”, “Price Impact” and “Liquidity Provider Fee” fields in order to make sure you perform the cleanest transaction with minimal impact to liquidity or unnecessary loss of your own funds due to fees, etc.

In the example shown in the image provided using TFD as an example, we can see that the “Minimum received” field is showing an amount similar to what we were quoted above, the “Price Impact” field indicates that our purchase will incur minimal impact to the price of the token and the “Liquidity Provider Fee” is reasonable for the size of our transaction. We can now hit “Swap” to buy Ethverse (ETHV).

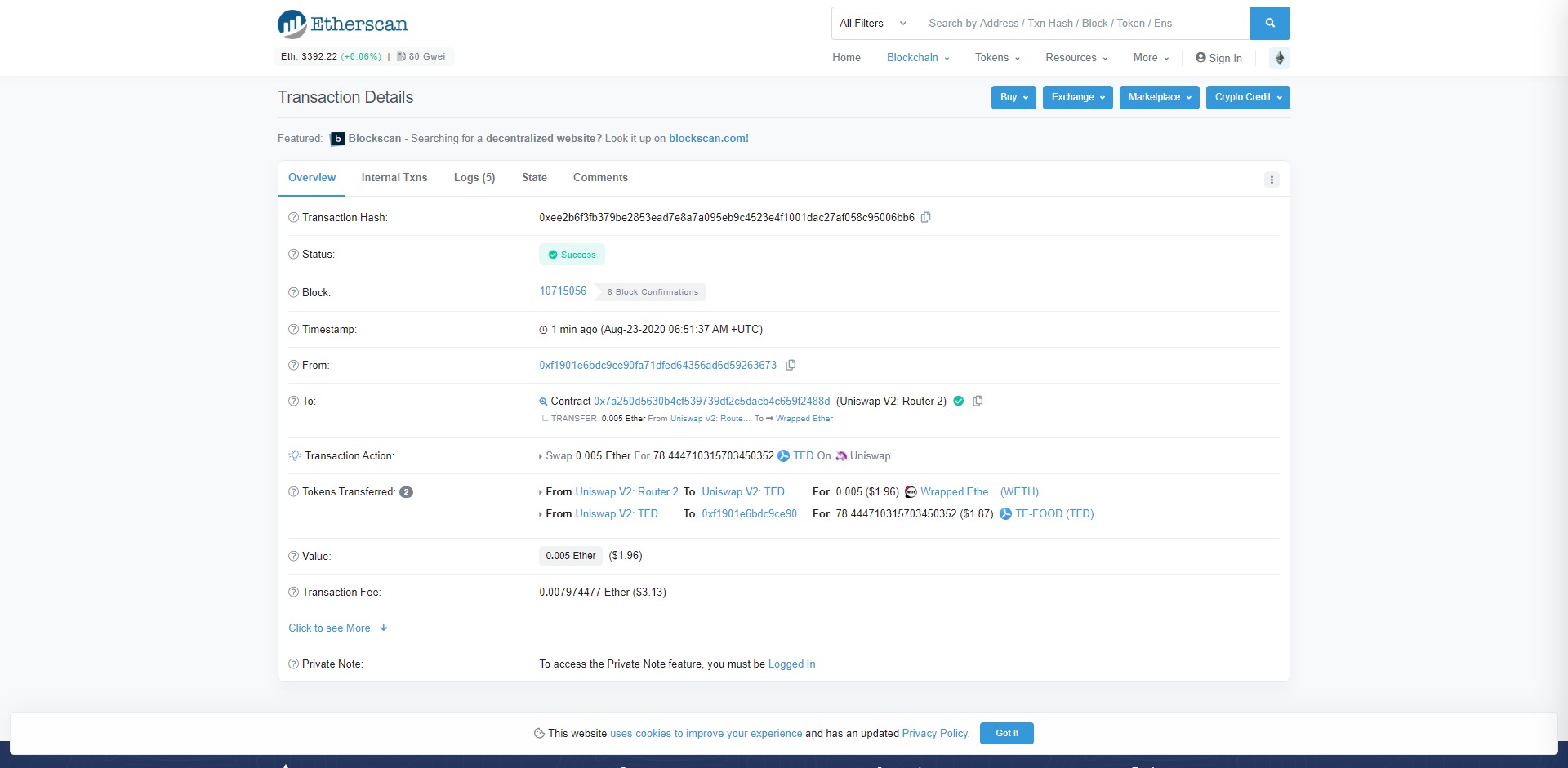

Step 4 -

After Buying Ethverse (ETHV)

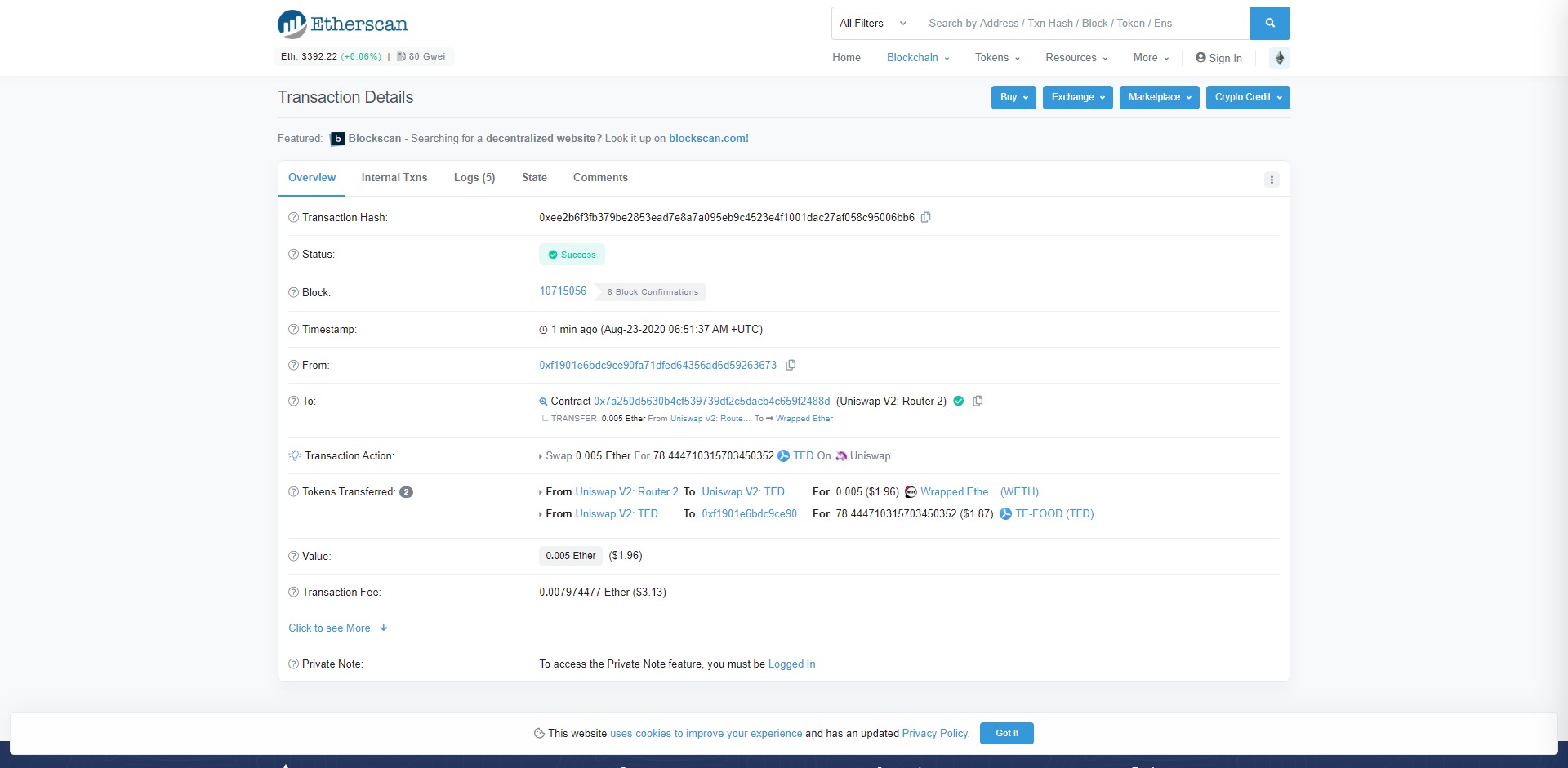

After you press “Swap” and buy your desired amount of Ethverse (ETHV), you’ll want to check that you’ve received the correct amount of ETHV in your wallet and all processes have gone smoothly. Please note that in times of high network usage, you may suffer from large fees or an increase in transaction times.

From here you are free to withdraw your ETHV tokens out into another wallet or exchange that also supports Ethverse or simply hold them with the aim of selling or “swapping” the tokens at a higher price later on.

Uniswap has made the process of buying various ERC-20 tokens like ETHV far easier in comparison to older decentralized exchanges like IDEX and Etherdelta which made users interact with order books and a lack of liquidity. Through the use of liquidity pools on Uniswap, transactions can be made with confidence that slippage will be kept at a minimum.

Step 4 -

After Buying Ethverse (ETHV)

After you press “Swap” and buy your desired amount of Ethverse (ETHV), you’ll want to check that you’ve received the correct amount of ETHV in your wallet and all processes have gone smoothly. Please note that in times of high network usage, you may suffer from large fees or an increase in transaction times.

From here you are free to withdraw your ETHV tokens out into another wallet or exchange that also supports Ethverse or simply hold them with the aim of selling or “swapping” the tokens at a higher price later on.

Uniswap has made the process of buying various ERC-20 tokens like ETHV far easier in comparison to older decentralized exchanges like IDEX and Etherdelta which made users interact with order books and a lack of liquidity. Through the use of liquidity pools on Uniswap, transactions can be made with confidence that slippage will be kept at a minimum.

Congratulations!

You've just purchased Ethverse (ETHV) On Uniswap

That’s it!

There’s a ton of opportunities available on Uniswap and you’ve just bought Ethverse (ETHV) in a few simple steps. We highly recommend checking out the Uniswap Docs and finding out more about how you can contribute to liquidity.