How To Long Or Short MTA On FTX

A Step-by-Step Guide

Step 1 -

Long Or Short MTA With Up To 101x Leverage

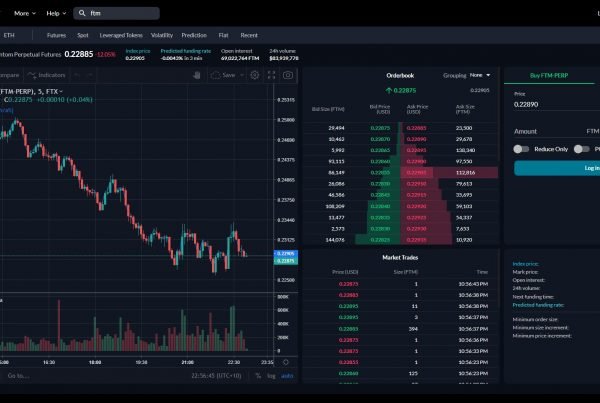

Trading the perpetual contracts offered by FTX Exchange is becoming an extremely popular way to either short MTA or long MTA, depending on which way Traders believe the Meta market is going to move next. FTX offers up to 101x leverage which, for example, allows Traders to go long or short on MTA with $1000 using only $10 of their account balance. MTA perpetual contracts on FTX are highly liquid and offer Traders the opportunity to enter large positions with minimal slippage.

Step 2 -

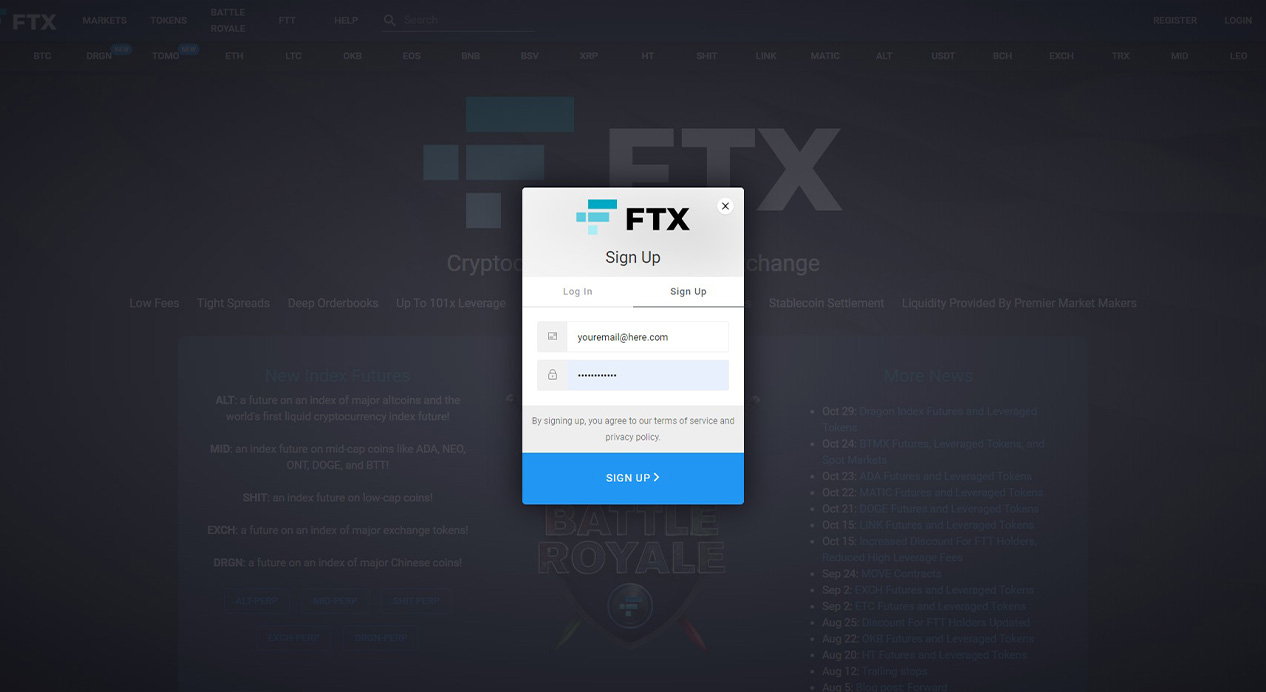

Sign Up To FTX Exchange

In order to long or short MTA, you’ll need to Sign Up to FTX Exchange. FTX is a cryptocurrency derivatives exchange built by traders, for traders. They’ve built a platform powerful enough for professional trading firms and intuitive enough for first-time users. FTX allows you to go long or short on Meta (MTA) with up to 101x leverage. FTX boasts over 40 perpetual contracts and is constantly adding more pairs like MTA via community votes and by keeping a close eye on what Traders want to trade. There’s no need to verify your KYC details unless you wish to withdraw over $1,000 USD per day.

Using the button below, you’ll save 5% on trading fees forever.

Step 2 -

Sign Up To FTX Exchange

In order to long or short MTA, you’ll need to Sign Up to FTX Exchange. FTX is a cryptocurrency derivatives exchange built by traders, for traders. They’ve built a platform powerful enough for professional trading firms and intuitive enough for first-time users. FTX allows you to go long or short on Meta (MTA) with up to 101x leverage. FTX boasts over 40 perpetual contracts and is constantly adding more pairs like MTA via community votes and by keeping a close eye on what Traders want to trade. There’s no need to verify your KYC details unless you wish to withdraw over $1,000 USD per day.

Using the button below, you’ll save 5% on trading fees forever.

Step 3 -

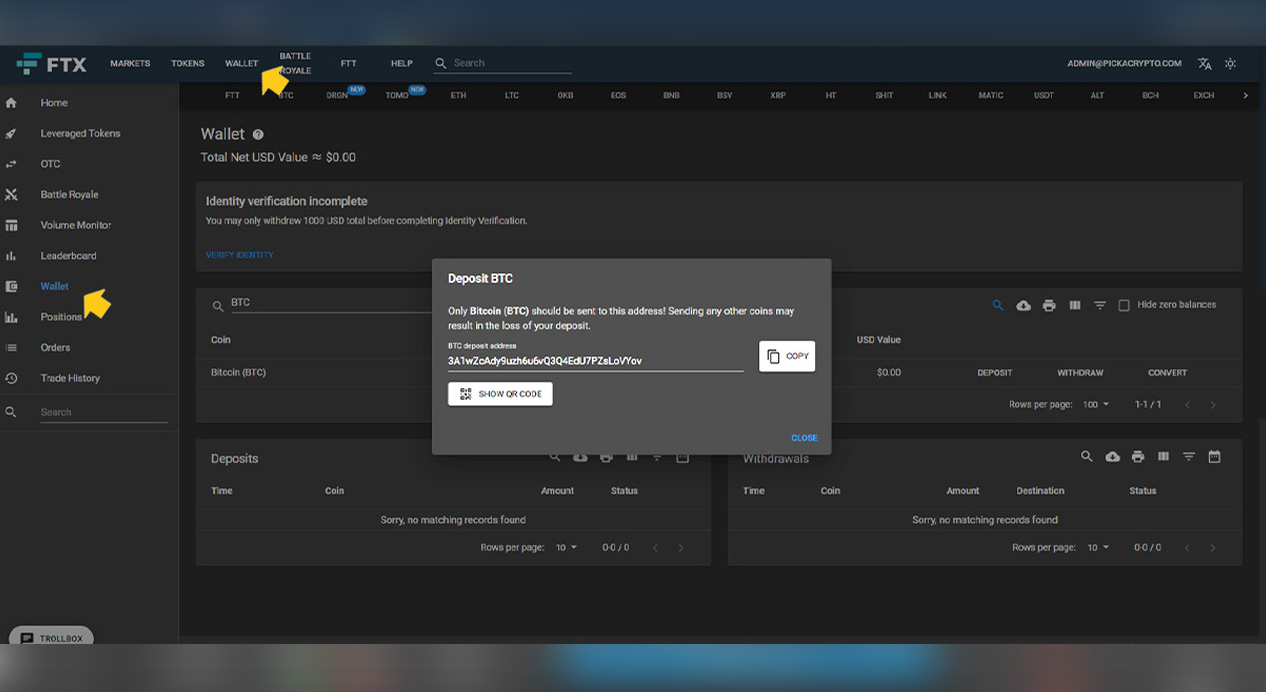

Deposit Bitcoin at FTX Exchange

You’ll now need to send your Bitcoin (BTC) over to FTX Exchange to begin trading MTA contracts. All exchanges have a similar deposit method. Transferring Bitcoin to FTX Exchange is the easiest way to get started although you can also deposit ETH and other major tokens. Unsure about how to send funds from Coinbase? (Follow this guide)

Make sure you’ve selected the correct coin you wish to deposit. BTC must be sent to a BTC deposit address, etc. Although sometimes recoverable, sending an asset to the wrong type of address should be avoided entirely.

Step 3 -

Deposit Bitcoin at FTX Exchange

You’ll now need to send your Bitcoin (BTC) over to FTX Exchange to begin trading MTA contracts. All exchanges have a similar deposit method. Transferring Bitcoin to FTX Exchange is the easiest way to get started although you can also deposit ETH and other major tokens. Unsure about how to send funds from Coinbase? (Follow this guide)

Make sure you’ve selected the correct coin you wish to deposit. BTC must be sent to a BTC deposit address, etc. Although sometimes recoverable, sending an asset to the wrong type of address should be avoided entirely.

Step 3 -

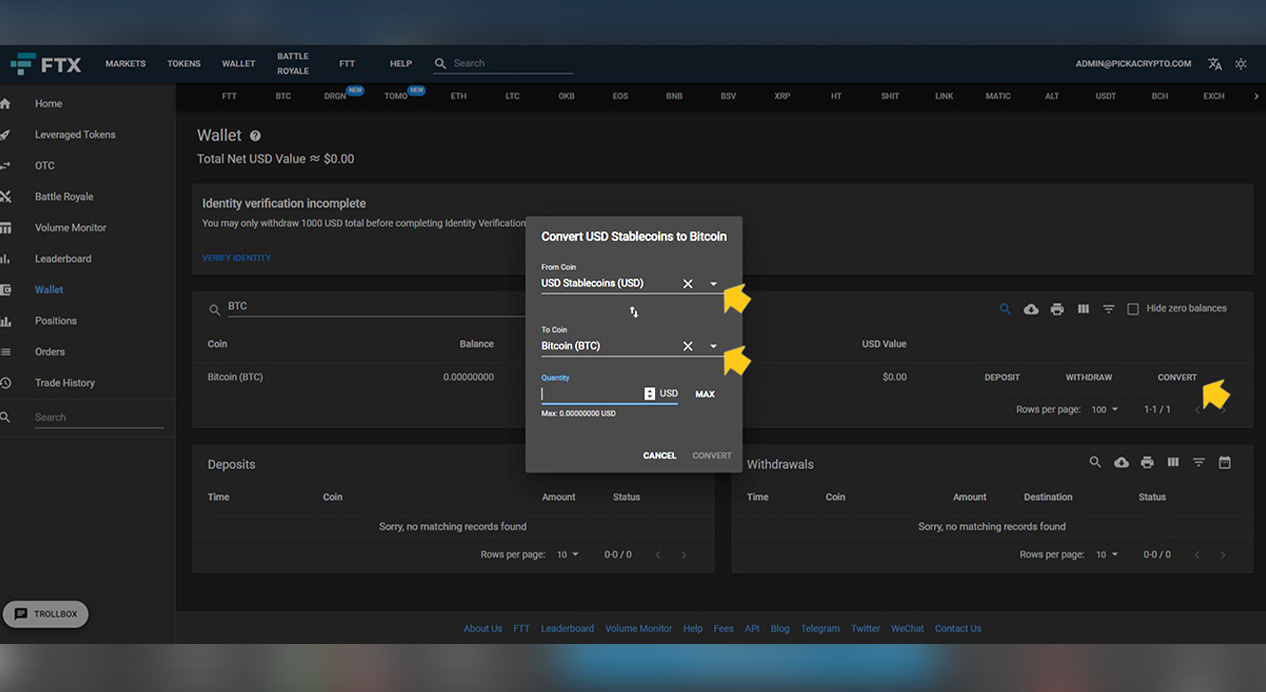

Convert BTC to USD

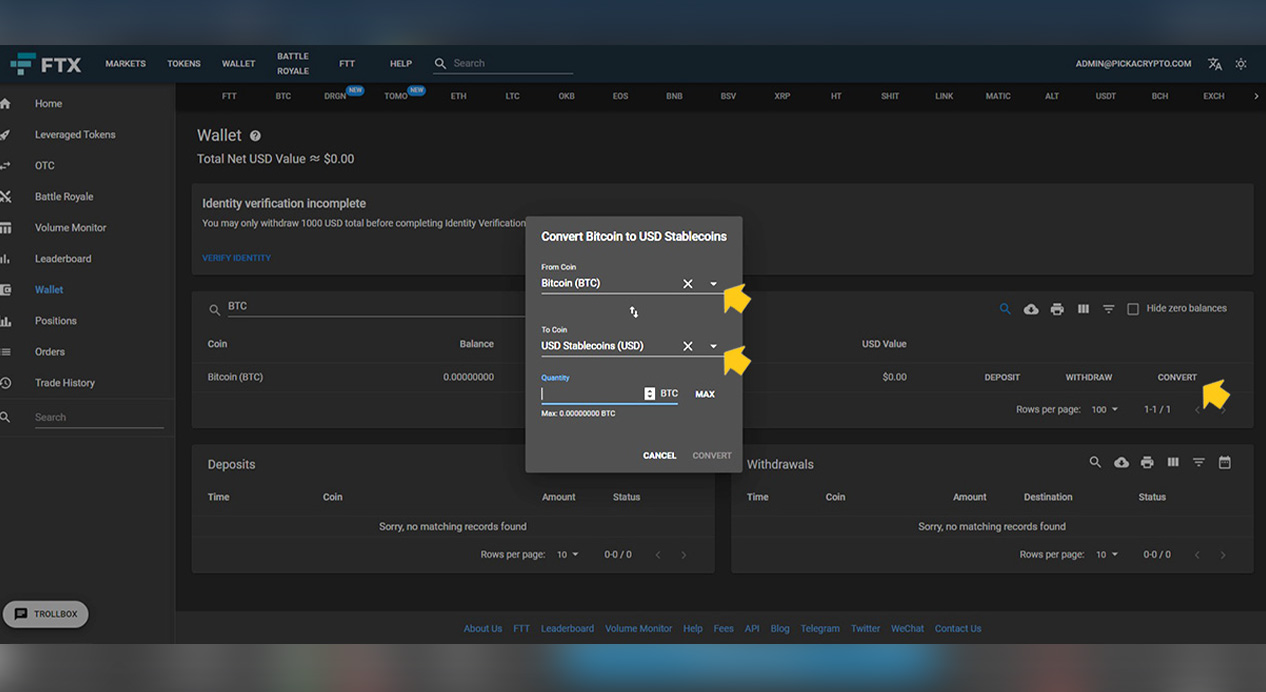

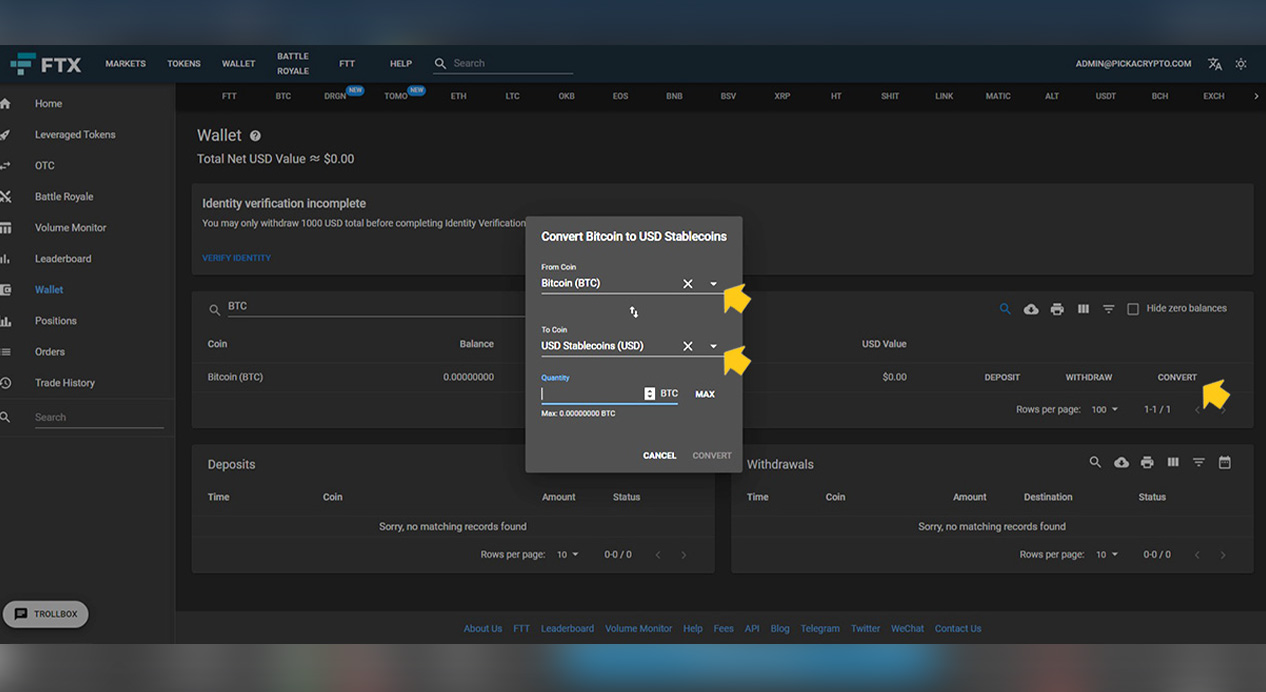

Once your deposit has confirmed, you’ll now have access to your funds and you can begin trading on FTX. To get started longing or shorting Meta (MTA) on FTX, you’ll want to click the “Convert” button and convert your BTC for stable USD tokens.

Following the screenshot provided, ensure the conversion is from Bitcoin (BTC) to USD Stablecoins (USD). Enter the amount of BTC you’d like to convert and click “Convert” to proceed.

Step 3 -

Convert BTC to USD

Once your deposit has confirmed, you’ll now have access to your funds and you can begin trading on FTX. To get started longing or shorting Meta (MTA) on FTX, you’ll want to click the “Convert” button and convert your BTC for stable USD tokens.

Following the screenshot provided, ensure the conversion is from Bitcoin (BTC) to USD Stablecoins (USD). Enter the amount of BTC you’d like to convert and click “Convert” to proceed.

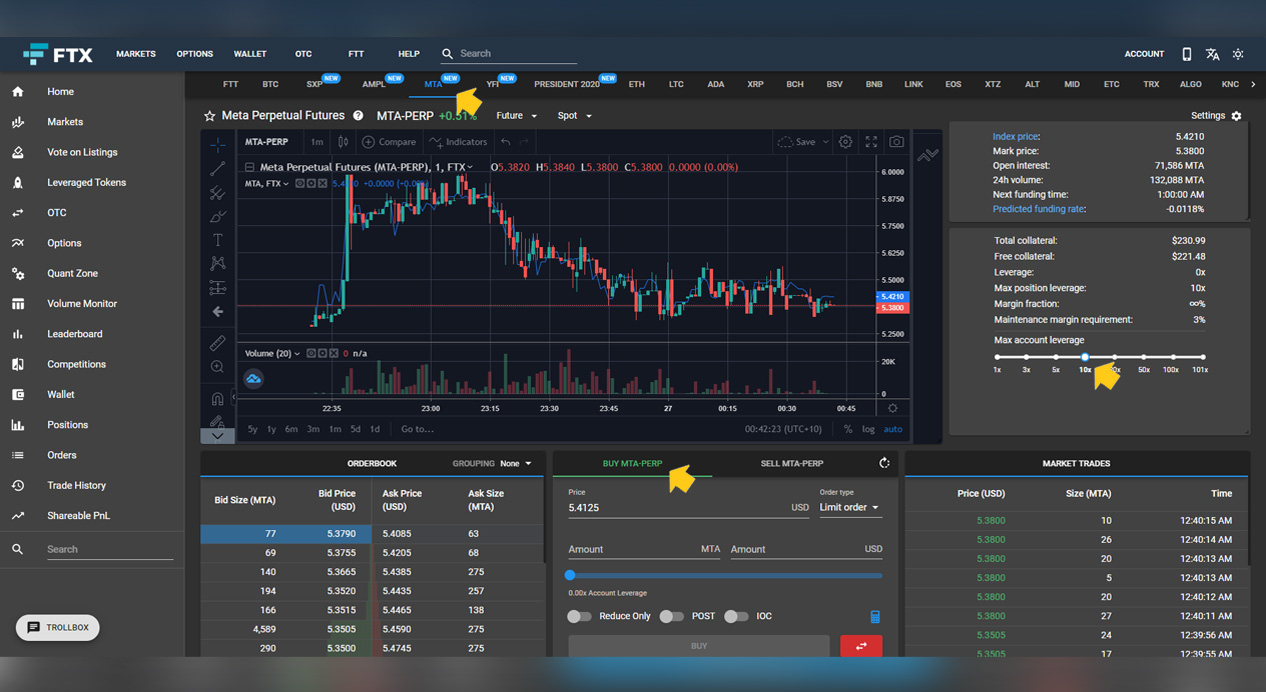

Step 4a -

Go LONG on MTA

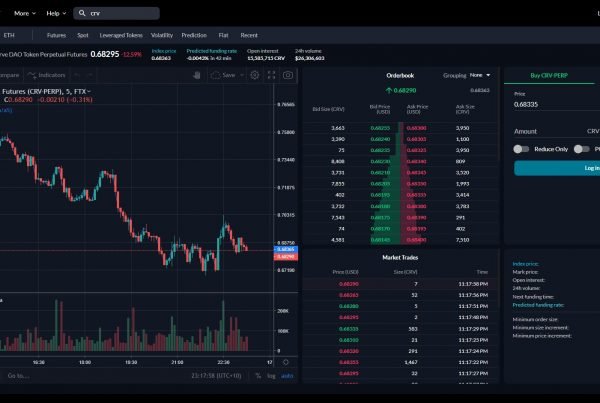

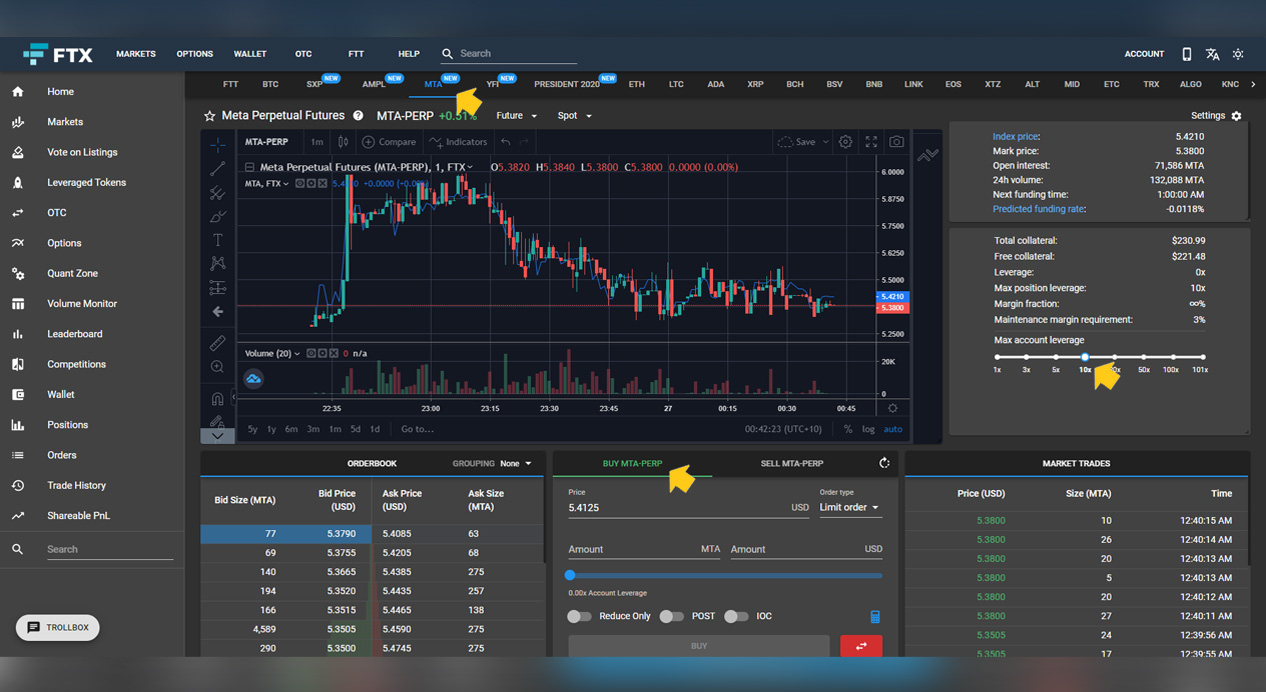

Once you’ve converted your BTC to USD and moved over to the “MTA” tab, you’ll be presented with a Price Chart (Center) and some Order Books (Bottom left). For now, we’re going to create our own Limit Order in order to LONG MTA.

The “Price” field will be automatically filled with the most recent price Meta (MTA) traded at, although this can be changed to your desired price. The “Amount” fields are either the amount of MTA or USD you wish to put down as collateral. Either field will populate depending on what you enter. Adjust the account leverage you would like to use if you’d like to take advantage of the 1-101x leverage FTX offers Traders on the MTA-PERP contract

When you’re happy, click “BUY” (“Deposit Collateral” is shown if no funds are available). Your LONG MTA order will be filled when a Seller sells their MTA for the price you submitted.

Step 4a -

Go LONG on MTA

Once you’ve converted your BTC to USD and moved over to the “MTA” tab, you’ll be presented with a Price Chart (Center) and some Order Books (Bottom left). For now, we’re going to create our own Limit Order in order to LONG MTA.

The “Price” field will be automatically filled with the most recent price Meta (MTA) traded at, although this can be changed to your desired price. The “Amount” fields are either the amount of MTA or USD you wish to put down as collateral. Either field will populate depending on what you enter. Adjust the account leverage you would like to use if you’d like to take advantage of the 1-101x leverage FTX offers Traders on the MTA-PERP contract

When you’re happy, click “BUY” (“Deposit Collateral” is shown if no funds are available). Your LONG MTA order will be filled when a Seller sells their MTA for the price you submitted.

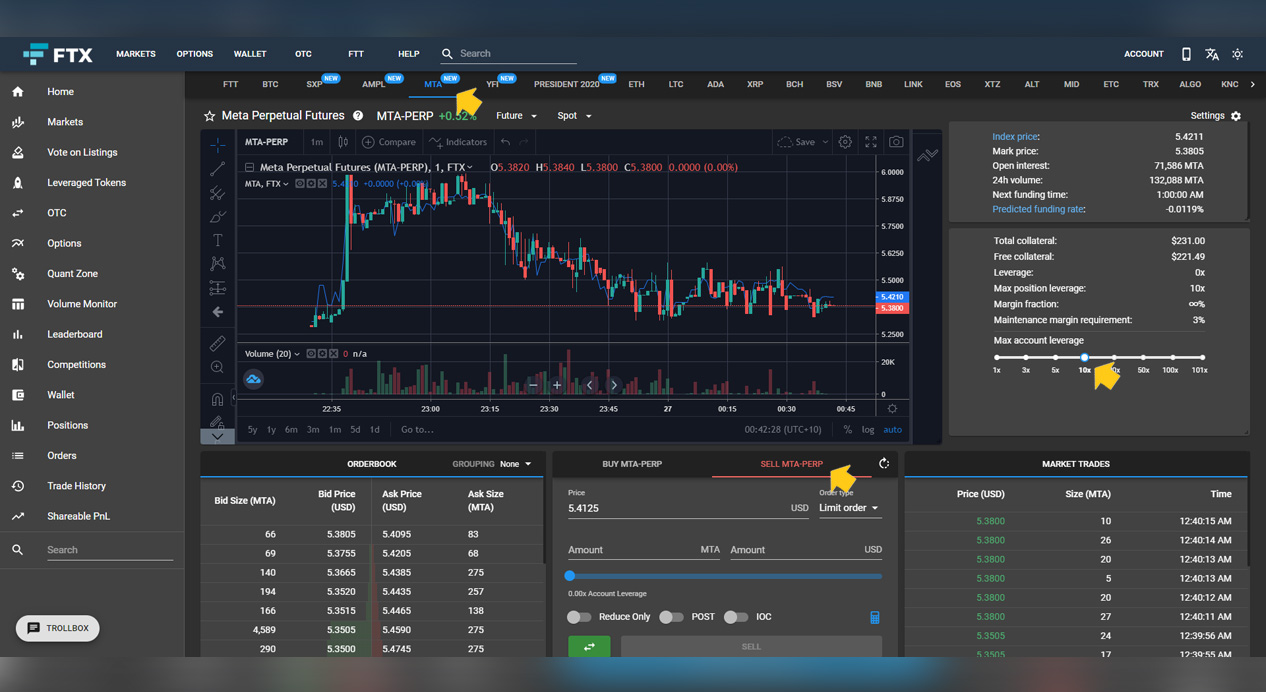

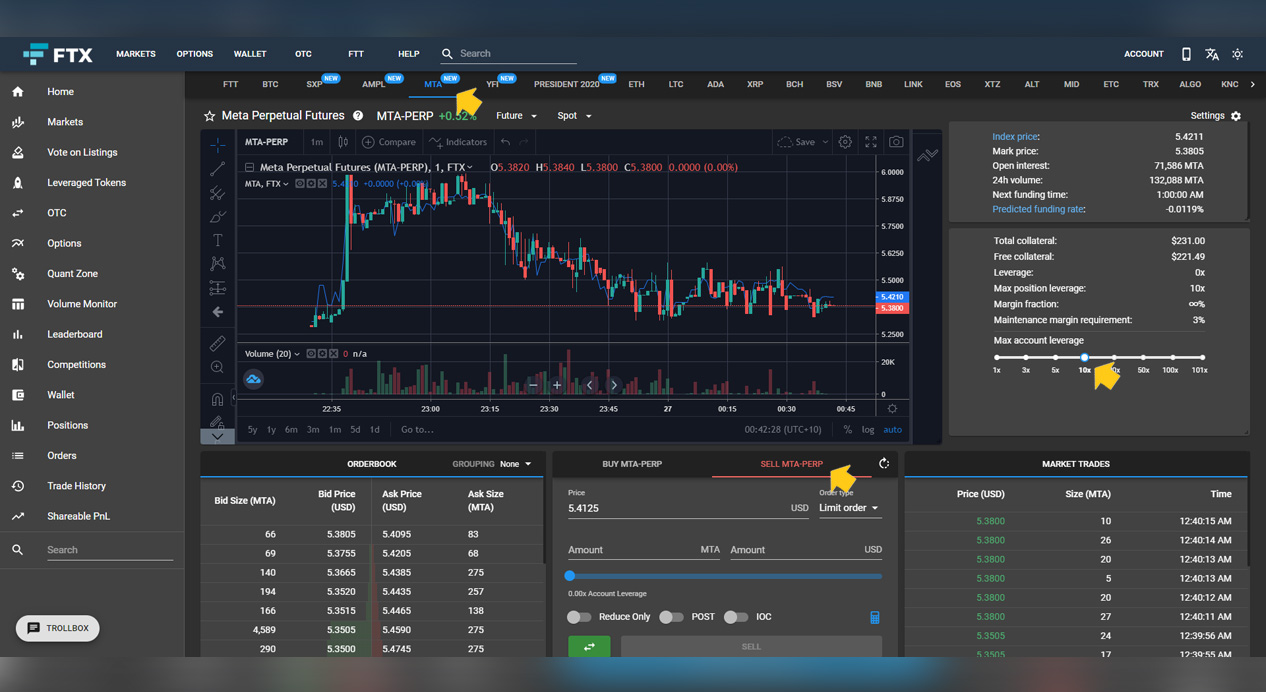

Step 4b -

Go SHORT on MTA

Alternatively, you can decide to SHORT MTA if you think the price will go down. The steps to short MTA are identical to those taken in order to long MTA. You’re betting the price will go down, so remember to set your stop-loss and target price accordingly. If you’re new to shorting cryptocurrencies, move slowly at first.

The “Price” field will be automatically filled with the most recent price Meta (MTA) traded at, although this can be changed to your desired price. The “Amount” fields are either the amount of MTA or USD you wish to put down as collateral. Either field will populate depending on what you enter. Adjust the account leverage you would like to use if you’d like to take advantage of the 1-101x leverage FTX offers Traders on the MTA-PERP contract.

When you’re happy, click “SELL” (“Deposit Collateral” is shown if no funds are available). Your SHORT MTA order will be filled when a Seller sells their MTA for the price you submitted.

Step 4b -

Go SHORT on MTA

Alternatively, you can decide to SHORT MTA if you think the price will go down. The steps to short MTA are identical to those taken in order to long MTA. You’re betting the price will go down, so remember to set your stop-loss and target price accordingly. If you’re new to shorting cryptocurrencies, move slowly at first.

The “Price” field will be automatically filled with the most recent price Meta (MTA) traded at, although this can be changed to your desired price. The “Amount” fields are either the amount of MTA or USD you wish to put down as collateral. Either field will populate depending on what you enter. Adjust the account leverage you would like to use if you’d like to take advantage of the 1-101x leverage FTX offers Traders on the MTA-PERP contract.

When you’re happy, click “SELL” (“Deposit Collateral” is shown if no funds are available). Your SHORT MTA order will be filled when a Seller sells their MTA for the price you submitted.

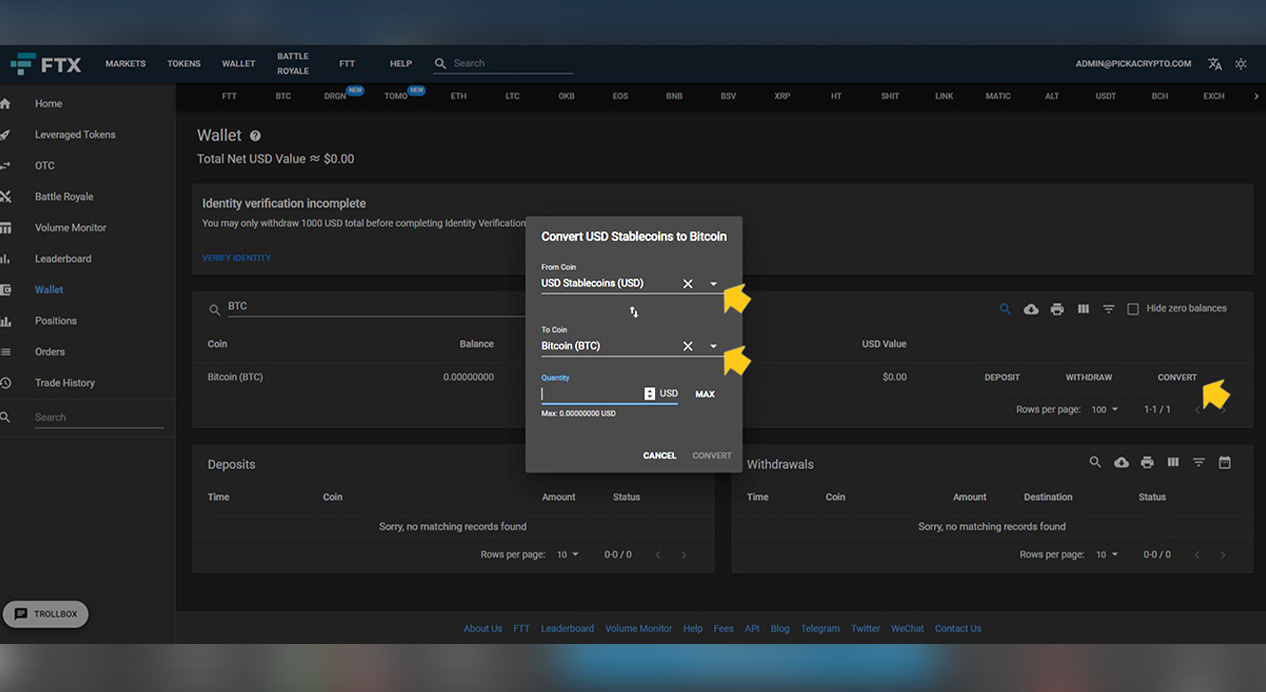

Step 5 -

Convert USD to BTC

Regardless of whether you chose to LONG or SHORT MTA, after the trade you may want to convert your USD balance back to BTC for withdrawal. FTX exchange makes converting USD back into BTC just as simple as it was when you started. Go back to your Wallet, search “USD” and click “Convert”. If you prefer to keep your balance in USD Stablecoins to protect your account value at all times, FTX does offer USD withdrawals back into your bank account after KYC.

Following the screenshot provided, ensure the conversion is from USD Stablecoins (USD) to Bitcoin (BTC). Enter the amount of USD you’d like to convert and click “Convert” to proceed.

Step 5 -

Convert USD to BTC

Regardless of whether you chose to LONG or SHORT MTA, after the trade you may want to convert your USD balance back to BTC for withdrawal. FTX exchange makes converting USD back into BTC just as simple as it was when you started. Go back to your Wallet, search “USD” and click “Convert”. If you prefer to keep your balance in USD Stablecoins to protect your account value at all times, FTX does offer USD withdrawals back into your bank account after KYC.

Following the screenshot provided, ensure the conversion is from USD Stablecoins (USD) to Bitcoin (BTC). Enter the amount of USD you’d like to convert and click “Convert” to proceed.

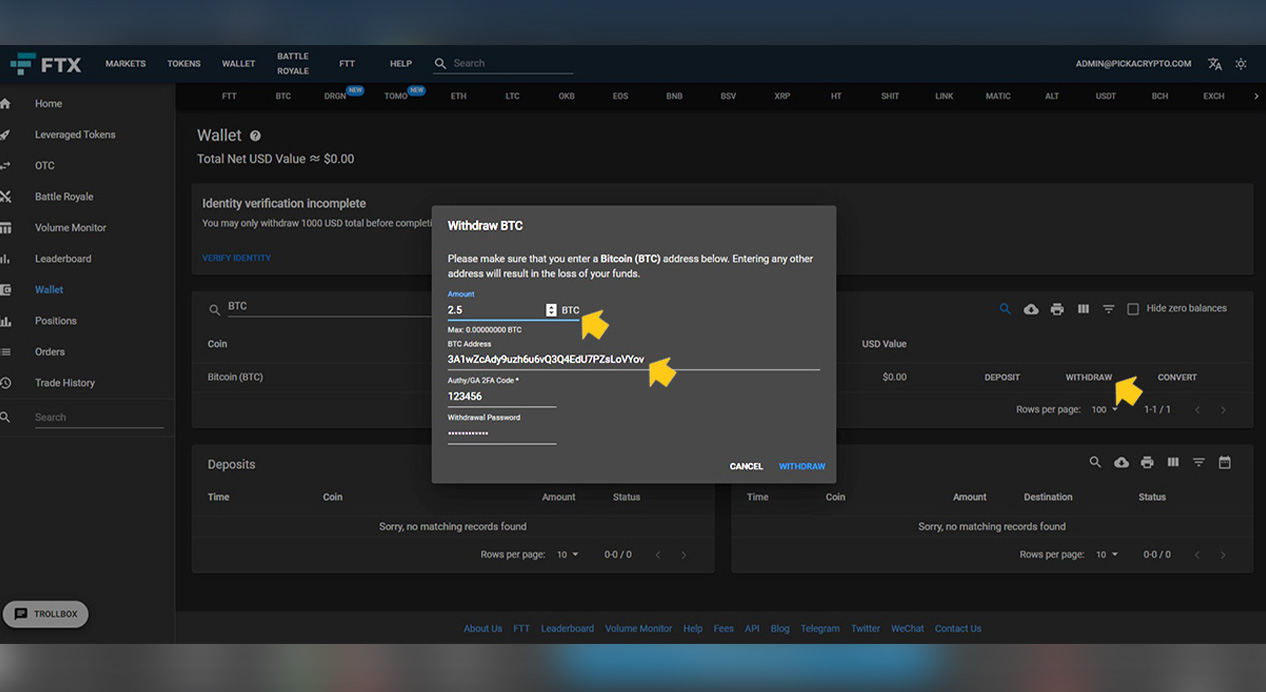

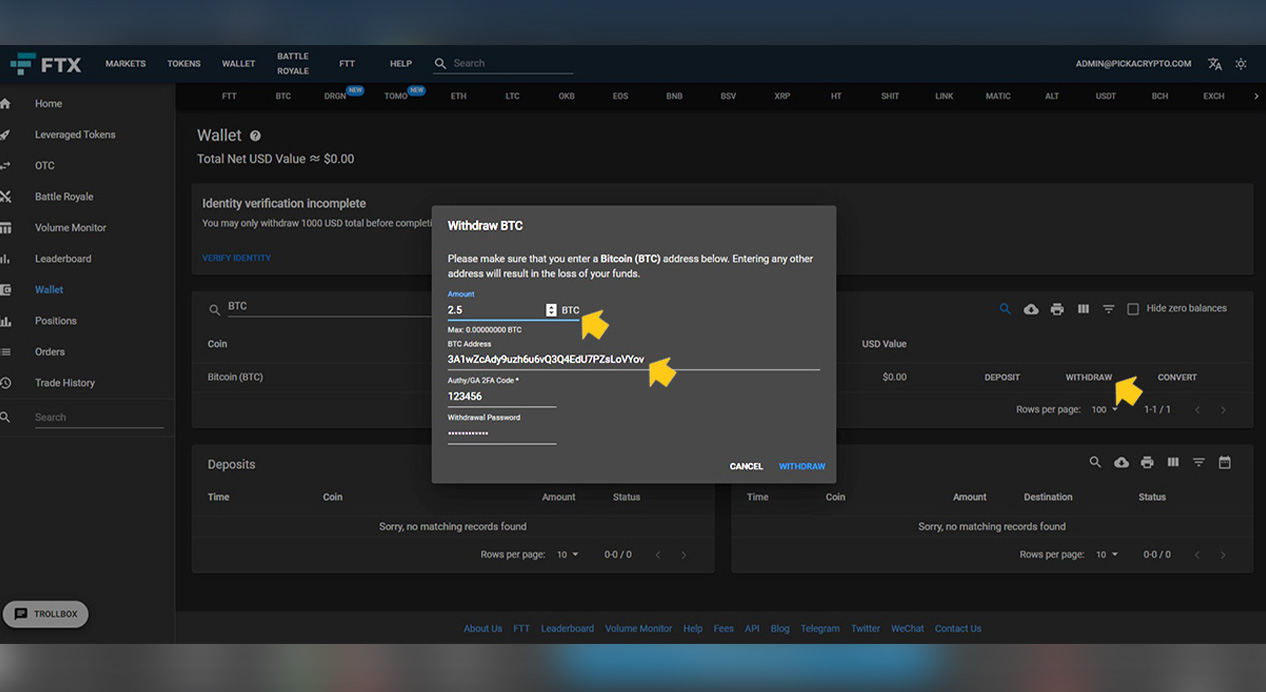

Step 6 -

Withdraw Your Funds

Unless you’re trading, never keep your coins on an exchange for an extended period of time. To withdraw your Bitcoin (BTC) or whatever funds you converted your USD to, go to your Wallet and click “Withdraw” on your new balance. Bitcoin (BTC) can be safely stored using a software wallet like Exodus or a hardware wallet like a Ledger Nano X.

Enter the amount of Bitcoin (BTC) you’d like to withdraw in the text-box provided. Enjoy the fee-less withdrawals FTX Exchange offers and make sure the withdraw address you have entered is yours and is correct.

When you’re happy, click “Withdraw”. You may be asked for phone/email verification before a withdrawal can be processed.

Step 6 -

Withdraw Your Funds

Unless you’re trading, never keep your coins on an exchange for an extended period of time. To withdraw your Bitcoin (BTC) or whatever funds you converted your USD to, go to your Wallet and click “Withdraw” on your new balance. Bitcoin (BTC) can be safely stored using a software wallet like Exodus or a hardware wallet like a Ledger Nano X.

Enter the amount of Bitcoin (BTC) you’d like to withdraw in the text-box provided. Enjoy the fee-less withdrawals FTX Exchange offers and make sure the withdraw address you have entered is yours and is correct.

When you’re happy, click “Withdraw”. You may be asked for phone/email verification before a withdrawal can be processed.

Trade On FTX. A Cryptocurrency Derivatives Exchange Offering So Much More

Trade On FTX.

A Cryptocurrency Derivatives Exchange Offering So Much More

Congratulations!

You're Ready To Trade On FTX Exchange

That’s it!

There’s a ton of Contracts available on FTX and you’ve just traded your first one. We highly recommend exploring other options as more become available on the platform.